How to Write Your College Essay: The Ultimate Step-by-Step Guide

Getting ready to start your college essay? Your essay is very important to your application — especially if you’re applying to selective colleges.

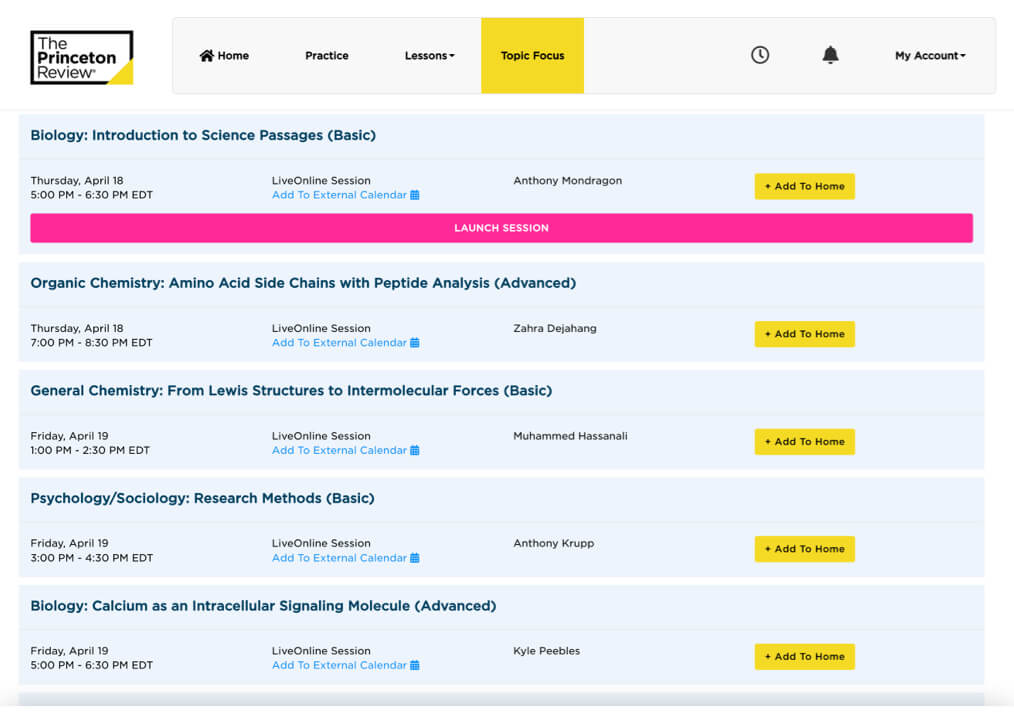

Become a stronger writer by reviewing your peers’ essays and get your essay reviewed as well for free.

We have regular livestreams during which we walk you through how to write your college essay and review essays live.

College Essay Basics

Just getting started on college essays? This section will guide you through how you should think about your college essays before you start.

- Why do essays matter in the college application process?

- What is a college application theme and how do you come up with one?

- How to format and structure your college essay

Before you move to the next section, make sure you understand:

How a college essay fits into your application

What a strong essay does for your chances

How to create an application theme

Learn the Types of College Essays

Next, let’s make sure you understand the different types of college essays. You’ll most likely be writing a Common App or Coalition App essay, and you can also be asked to write supplemental essays for each school. Each essay has a prompt asking a specific question. Each of these prompts falls into one of a few different types. Understanding the types will help you better answer the prompt and structure your essay.

- How to Write a Personal Statement That Wows Colleges

- Personal Statement Essay Examples

- How to Write a Stellar Extracurricular Activity Essay

- Extracurricular Essay Examples

- Tips for Writing a Diversity College Essay

- Diversity Essay Examples

- Tips for Writing a Standout Community Service Essay

- How to Write the “Why This Major” Essay

- How to Write a “Why This Major” Essay if You’re Undecided

- How to write the “Why This College” Essay

- How to Research a College to Write the “Why This College” Essay

- Why This College Essay Examples

- How to Write The Overcoming Challenges Essay

- Overcoming Challenges Essay Examples

Identify how each prompt fits into an essay type

What each type of essay is really asking of you

How to write each essay effectively

The Common App essay

Almost every student will write a Common App essay, which is why it’s important you get this right.

- How to Write the Common App Essay

- Successful Common App Essay Examples

- 5 Awesome College Essay Topics + Sample Essays

- 11 Cliché College Essay Topics + How to Fix Them

How to choose which Common App prompts to answer

How to write a successful Common App essay

What to avoid to stand out to admissions officers

Supplemental Essay Guides

Many schools, especially competitive ones, will ask you to write one or more supplemental essays. This allows a school to learn more about you and how you might fit into their culture.

These essays are extremely important in standing out. We’ve written guides for all the top schools. Follow the link below to find your school and read last year’s essay guides to give you a sense of the essay prompts. We’ll update these in August when schools release their prompts.

See last year’s supplemental essay guides to get a sense of the prompts for your schools.

Essay brainstorming and composition

Now that you’re starting to write your essay, let’s dive into the writing process. Below you’ll find our top articles on the craft of writing an amazing college essay.

- Where to Begin? 3 Personal Essay Brainstorming Exercises

- Creating the First Draft of Your College Application Essay

- How to Get the Perfect Hook for Your College Essay

- What If I Don’t Have Anything Interesting To Write About In My College Essay?

- 8 Do’s and Don’t for Crafting Your College Essay

- Stuck on Your College Essay? 8 Tips for Overcoming Writer’s Block

Understand how to write a great hook for your essay

Complete the first drafts of your essay

Editing and polishing your essay

Have a first draft ready? See our top editing tips below. Also, you may want to submit your essay to our free Essay Peer Review to get quick feedback and join a community of other students working on their essays.

- 11 Tips for Proofreading and Editing Your College Essay

- Getting Help with Your College Essay

- 5 DIY Tips for Editing Your College Essay

- How Long Should Your College Essay Be?

- Essential Grammar Rules for Your College Apps

- College Essay Checklist: Are You Ready to Submit?

Proofread and edited your essay.

Had someone else look through your essay — we recommend submitting it for a peer review.

Make sure your essay meets all requirements — consider signing up for a free account to view our per-prompt checklists to help you understand when you’re really ready to submit.

Advanced College Essay Techniques

Let’s take it one step further and see how we can make your college essay really stand out! We recommend reading through these posts when you have a draft to work with.

- 10 Guidelines for Highly Readable College Essays

- How to Use Literary Devices to Enhance Your Essay

- How to Develop a Personalized Metaphor for Your College Applications

How to Write a College Application Essay

Find the right college for you..

Your essay reveals something important about you that your grades and test scores can't─your personality. It can give admissions officers a sense of who you are and showcase your writing ability. Here are some things that admissions officers look for in a personal essay for college.

1. Open Strong.

Knowing how to start a college essay can create a strong opening paragraph that immediately captures the reader’s interest. You want to make the admissions officer reading your essay curious about what you say next.

2. Show You Can Write.

Colleges want to see that you have a command of the basics of good writing, which is a key component of success in college.

3. Answer the Prompt.

Admissions officers also want to see that the student can give a direct answer while sticking to a comprehensive narrative. When writing college essays, consider the point you want to make and develop a fleshed-out response that fits the prompt. Avoid force-fitting prewritten pieces. Approach every personal essay prompt as if it's your first.

4. Stick to Your Style.

Writing college essays isn't about using flowery or verbose prose. Avoid leaning too heavily on the thesaurus to sound impressive. Choose a natural writing style that’s appropriate for the subject matter.

Also, avoid stressing about trying to write what you think colleges want to see. Learning how to draft a good essay for college is about showcasing who you are. Stay true to your voice. Keep in mind that authenticity is more important than anything else.

5. Proofread.

Correct grammar, punctuation, and spelling are essential. Proofread several times after you've finished. Then ask a teacher, parent, or college English major to give it a quick read as well.

6. Keep Track of Length.

Finally, admissions officers value succinctness. Remember to pay attention to the recommended essay length or word count.

Bonus Tips and College Essay Writing Help

For more on how to write a college essay, check out these Tips for Writing Your College Admissions Essay .

What is the college application essay?

A personal essay for college applications is an opportunity for admission admissions panels to get more insight into who you are and what you have to offer. It's often the most personal component of the application, going beyond grades and standardized test scores. Essays usually have open-ended prompts, allowing you to flex your writing skills and make a personal statement.

Does my college application essay really matter?

Learning how to write a successful essay for college is crucial. This essay's exact weight on your chances of acceptance varies from one school to the next. But it's an element of your application that all admissions teams consider. Your essay could be the thing that gets you off a waiting list or gives you a competitive edge over other applicants.

What are colleges looking for in my application essay?

Knowing what to include in a college essay is half the battle. Admissions teams look for many things, but the most influential are authenticity, writing ability, character details, and positive traits. The purpose of the essay is to shed light on your background and gain perspective on your real-world experiences.

When should I start writing my college essay?

Because you'll want to tailor each application to each school, expect to write multiple personal essays. Advisers typically recommend starting these pieces during the summer before your senior year of high school. This will give you ample time to concentrate on writing a college essay before you're hit with schoolwork.

What can I do to write an effective college essay if I'm not a strong writer?

Good writing skills matter, but the best college essay is about the quality of your response. Authentic stories in a natural voice have impact. The story you want to tell about yourself will work better for you if it’s told in language that’s not overly sophisticated. Work with a writing coach for help with the academic aspects. Make responding with substance a priority.

How can I write my college essay if I have no monumental experiences?

You don't need life-changing moments to impress an admissions panel. Think about your personal experiences. Describe moments that left a lasting impact. The important thing is to have a fleshed-out narrative that provides insight into your life and way of thinking. Some of the best essays revolve around meaningful moments rather than flashy ones.

How should I start brainstorming topics for my college essay?

Most colleges provide open-ended prompts. Using the topic as inspiration, think about critical milestones or essential lessons you learned during your academic career. Tell stories about real-life experiences that have shaped the person you are. Write them down to brainstorm ideas. Choose stories that highlight your best traits.

What is a good list of essay topics to start with? What essay topics should I avoid?

Good topics when writing college essays include personal achievements, meaningful lessons, life-changing challenges, and situations that fostered personal growth. It's best to avoid anything too intimate or controversial. You want to open up, but it's not a good idea to go overboard or alienate members of the admissions panel.

What format should I use for my college essay?

Read the prompt and essay instructions thoroughly to learn how to start off a college essay. Some colleges provide guidance about formatting. If not, the best course of action is to stick with a college standard like the MLA format.

How long should my essay be?

The average length of a personal essay for college is 400─600 words. Always read the prompt. Follow the instructions provided in the application.

Who should I ask to review my college essay?

Turn to your school counselor for review. They understand what college admissions panels are looking for, and they can provide valuable insight into your piece's quality. You can also reach out to English teachers and other educators for proofreading.

Related Articles

Have a language expert improve your writing

Check your paper for plagiarism in 10 minutes, generate your apa citations for free.

- Knowledge Base

- College essay

- College Essay Examples | What Works and What Doesn’t

College Essay Examples | What Works and What Doesn't

Published on November 8, 2021 by Kirsten Courault . Revised on August 14, 2023.

One effective method for improving your college essay is to read example essays . Here are three sample essays, each with a bad and good version to help you improve your own essay.

Table of contents

Essay 1: sharing an identity or background through a montage, essay 2: overcoming a challenge, a sports injury narrative, essay 3: showing the influence of an important person or thing, other interesting articles, frequently asked questions about college application essays.

This essay uses a montage structure to show snapshots of a student’s identity and background. The writer builds her essay around the theme of the five senses, sharing memories she associates with sight, sound, smell, touch, and taste.

In the weak rough draft, there is little connection between the individual anecdotes, and they do not robustly demonstrate the student’s qualities.

In the final version, the student uses an extended metaphor of a museum to create a strong connection among her stories, each showcasing a different part of her identity. She draws a specific personal insight from each memory and uses the stories to demonstrate her qualities and values.

How My Five Senses Record My Life

Throughout my life, I have kept a record of my life’s journey with my five senses. This collection of memories matters a great deal because I experience life every day through the lens of my identity.

“Chinese! Japanese!”

My classmate pulls one eye up and the other down.

“Look what my parents did to me!”

No matter how many times he repeats it, the other kids keep laughing. I focus my almond-shaped eyes on the ground, careful not to attract attention to my discomfort, anger, and shame. How could he say such a mean thing about me? What did I do to him? Joseph’s words would engrave themselves into my memory, making me question my appearance every time I saw my eyes in the mirror.

Soaking in overflowing bubble baths with Andrew Lloyd Webber belting from the boombox.

Listening to “Cell Block Tango” with my grandparents while eating filet mignon at a dine-in show in Ashland.

Singing “The Worst Pies in London” at a Korean karaoke club while laughing hysterically with my brother, who can do an eerily spot-on rendition of Sweeney Todd.

Taking car rides with Mom in the Toyota Sequoia as we compete to hit the high note in “Think of Me” from The Phantom of the Opera . Neither of us stands a chance!

The sweet scent of vegetables, Chinese noodles, and sushi wafts through the room as we sit around the table. My grandma presents a good-smelling mixture of international cuisine for our Thanksgiving feast. My favorite is the Chinese food that she cooks. Only the family prayer stands between me and the chance to indulge in these delicious morsels, comforting me with their familiar savory scents.

I rinse a faded plastic plate decorated by my younger sister at the Waterworks Art Center. I wear yellow rubber gloves to protect my hands at Mom’s insistence, but I can still feel the warm water that offers a bit of comfort as I finish the task at hand. The crusted casserole dish with stubborn remnants from my dad’s five-layer lasagna requires extra effort, so I fill it with Dawn and scalding water, setting it aside to soak. I actually don’t mind this daily chore.

I taste sweat on my upper lip as I fight to continue pedaling on a stationary bike. Ava’s next to me and tells me to go up a level. We’re biking buddies, dieting buddies, and Saturday morning carbo-load buddies. After the bike display hits 30 minutes, we do a five-minute cool down, drink Gatorade, and put our legs up to rest.

My five senses are always gathering new memories of my identity. I’m excited to expand my collection.

Word count: 455

College essay checklist

Topic and structure

- I’ve selected a topic that’s meaningful to me.

- My essay reveals something different from the rest of my application.

- I have a clear and well-structured narrative.

- I’ve concluded with an insight or a creative ending.

Writing style and tone

- I’ve crafted an introduction containing vivid imagery or an intriguing hook that grabs the reader’s attention.

- I’ve written my essay in a way that shows instead of tells.

- I’ve used appropriate style and tone for a college essay.

- I’ve used specific, vivid personal stories that would be hard to replicate.

- I’ve demonstrated my positive traits and values in my essay.

- My essay is focused on me, not another person or thing.

- I’ve included self-reflection and insight in my essay.

- I’ve respected the word count , remaining within 10% of the upper word limit.

Making Sense of My Identity

Welcome to The Rose Arimoto Museum. You are about to enter the “Making Sense of My Identity” collection. Allow me to guide you through select exhibits, carefully curated memories from Rose’s sensory experiences.

First, the Sight Exhibit.

“Chinese! Japanese!”

“Look what my parents did to me!”

No matter how many times he repeats it, the other kids keep laughing. I focus my almond-shaped eyes on the ground, careful not to attract attention as my lip trembles and palms sweat. Joseph couldn’t have known how his words would engrave themselves into my memory, making me question my appearance every time I saw my eyes in the mirror.

Ten years later, these same eyes now fixate on an InDesign layout sheet, searching for grammar errors while my friend Selena proofreads our feature piece on racial discrimination in our hometown. As we’re the school newspaper editors, our journalism teacher Ms. Riley allows us to stay until midnight to meet tomorrow’s deadline. She commends our work ethic, which for me is fueled by writing一my new weapon of choice.

Next, you’ll encounter the Sound Exhibit.

Still, the world is my Broadway as I find my voice on stage.

Just below, enter the Smell Exhibit.

While I help my Pau Pau prepare dinner, she divulges her recipe for cha siu bau, with its soft, pillowy white exterior hiding the fragrant filling of braised barbecue pork inside. The sweet scent of candied yams, fun see , and Spam musubi wafts through the room as we gather around our Thankgsiving feast. After our family prayer, we indulge in these delicious morsels until our bellies say stop. These savory scents of my family’s cultural heritage linger long after I’ve finished the last bite.

Next up, the Touch Exhibit.

I rinse a handmade mug that I had painstakingly molded and painted in ceramics class. I wear yellow rubber gloves to protect my hands at Mom’s insistence, but I can still feel the warm water that offers a bit of comfort as I finish the task at hand. The crusted casserole dish with stubborn remnants from my dad’s five-layer lasagna requires extra effort, so I fill it with Dawn and scalding water, setting it aside to soak. For a few fleeting moments, as I continue my nightly chore, the pressure of my weekend job, tomorrow’s calculus exam, and next week’s track meet are washed away.

Finally, we end with the Taste Exhibit.

My legs fight to keep pace with the stationary bike as the salty taste of sweat seeps into corners of my mouth. Ava challenges me to take it up a level. We always train together一even keeping each other accountable on our strict protein diet of chicken breasts, broccoli, and Muscle Milk. We occasionally splurge on Saturday mornings after interval training, relishing the decadence of everything bagels smeared with raspberry walnut cream cheese. But this is Wednesday, so I push myself. I know that once the digital display hits 30:00, we’ll allow our legs to relax into a five-minute cool down, followed by the fiery tang of Fruit Punch Gatorade to rehydrate.

Thank you for your attention. This completes our tour. I invite you to rejoin us for next fall’s College Experience collection, which will exhibit Rose’s continual search for identity and learning.

Word count: 649

- I’ve crafted an essay introduction containing vivid imagery or an intriguing hook that grabs the reader’s attention.

Prevent plagiarism. Run a free check.

This essay uses a narrative structure to recount how a student overcame a challenge, specifically a sports injury. Since this topic is often overused, the essay requires vivid description, a memorable introduction and conclusion , and interesting insight.

The weak rough draft contains an interesting narrative, insight, and vivid imagery, but it has an overly formal tone that distracts the reader from the story. The student’s use of elaborate vocabulary in every sentence makes the essay sound inauthentic and stilted.

The final essay uses a more natural, conversational tone and chooses words that are vivid and specific without being pretentious. This allows the reader to focus on the narrative and appreciate the student’s unique insight.

One fateful evening some months ago, a defensive linebacker mauled me, his 212 pounds indisputably alighting upon my ankle. Ergo, an abhorrent cracking of calcified tissue. At first light the next day, I awoke cognizant of a new paradigm—one sans football—promulgated by a stabbing sensation that would continue to haunt me every morning of this semester.

It’s been an exceedingly taxing semester not being able to engage in football, but I am nonetheless excelling in school. That twist of fate never would have come to pass if I hadn’t broken my ankle. I still limp down the halls at school, but I’m feeling less maudlin these days. My friends don’t steer clear anymore, and I have a lot more of them. My teachers, emboldened by my newfound interest in learning, continually invite me to learn more and do my best. Football is still on hold, but I feel like I’m finally playing a game that matters.

Five months ago, right after my ill-fated injury, my friends’ demeanor became icy and remote, although I couldn’t fathom why. My teachers, in contrast, beckoned me close and invited me on a new learning journey. But despite their indubitably kind advances, even they recoiled when I drew near.

A few weeks later, I started to change my attitude vis-à-vis my newfound situation and determined to put my energy toward productive ends (i.e., homework). I wasn’t enamored with school. I never had been. Nevertheless, I didn’t abhor it either. I just preferred football.

My true turn of fate came when I started studying more and participating in class. I started to enjoy history class, and I grew interested in reading more. I discovered a volume of poems written by a fellow adventurer on the road of life, and I loved it. I ravenously devoured everything in the writer’s oeuvre .

As the weeks flitted past, I found myself spending my time with a group of people who were quite different from me. They participated in theater and played instruments in marching band. They raised their hands in class when the teacher posed a question. Because of their auspicious influence, I started raising my hand too. I am no longer vapid, and I now have something to say.

I am certain that your school would benefit from my miraculous academic transformation, and I entreat you to consider my application to your fine institution. Accepting me to your university would be an unequivocally righteous decision.

Word count: 408

- I’ve chosen a college essay topic that’s meaningful to me.

- I’ve respected the essay word count , remaining within 10% of the upper word limit.

As I step out of bed, the pain shoots through my foot and up my leg like it has every morning since “the game.” That night, a defensive linebacker tackled me, his 212 pounds landing decidedly on my ankle. I heard the sound before I felt it. The next morning, I awoke to a new reality—one without football—announced by a stabbing sensation that would continue to haunt me every morning of this semester.

My broken ankle broke my spirit.

My friends steered clear of me as I hobbled down the halls at school. My teachers tried to find the delicate balance between giving me space and offering me help. I was as unsure how to deal with myself as they were.

In time, I figured out how to redirect some of my frustration, anger, and pent-up energy toward my studies. I had never not liked school, but I had never really liked it either. In my mind, football practice was my real-life classroom, where I could learn all I ever needed to know.

Then there was that day in Mrs. Brady’s history class. We sang a ridiculous-sounding mnemonic song to memorize all the Chinese dynasties from Shang to Qing. I mumbled the words at first, but I got caught up in the middle of the laughter and began singing along. Starting that day, I began browsing YouTube videos about history, curious to learn more. I had started learning something new, and, to my surprise, I liked it.

With my afternoons free from burpees and scrimmages, I dared to crack open a few more of my books to see what was in them. That’s when my English poetry book, Paint Me Like I Am , caught my attention. It was full of poems written by students my age from WritersCorps. I couldn’t get enough.

I wasn’t the only one who was taken with the poems. Previously, I’d only been vaguely aware of Christina as one of the weird kids I avoided. Crammed in the margins of her high-top Chuck Taylors were scribbled lines of her own poetry and infinite doodles. Beyond her punk rock persona was a sensitive artist, puppy-lover, and environmental activist that a wide receiver like me would have never noticed before.

With Christina, I started making friends with people who once would have been invisible to me: drama geeks, teachers’ pets, band nerds. Most were college bound but not to play a sport. They were smart and talented, and they cared about people and politics and all sorts of issues that I hadn’t considered before. Strangely, they also seemed to care about me.

I still limp down the halls at school, but I don’t seem to mind as much these days. My friends don’t steer clear anymore, and I have a lot more of them. My teachers, excited by my newfound interest in learning, continually invite me to learn more and do my best. Football is still on hold, but I feel like I’m finally playing a game that matters.

My broken ankle broke my spirit. Then, it broke my ignorance.

Word count: 512

This essay uses a narrative structure to show how a pet positively influenced the student’s values and character.

In the weak draft, the student doesn’t focus on himself, instead delving into too much detail about his dog’s positive traits and his grandma’s illness. The essay’s structure is meandering, with tangents and details that don’t communicate any specific insight.

In the improved version, the student keeps the focus on himself, not his pet. He chooses the most relevant stories to demonstrate specific qualities, and the structure more clearly builds up to an insightful conclusion.

Man’s Best Friend

I desperately wanted a cat. I begged my parents for one, but once again, my sisters overruled me, so we drove up the Thompson Valley Canyon from Loveland to Estes Park to meet our newest family member. My sisters had already hatched their master plan, complete with a Finding Nemo blanket to entice the pups. The blanket was a hit with all of them, except for one—the one who walked over and sat in my lap. That was the day that Francisco became a Villanova.

Maybe I should say he was mine because I got stuck with all the chores. As expected, my dog-loving sisters were nowhere to be found! My mom was “extra” with all the doggy gear. Cisco even had to wear these silly little puppy shoes outside so that when he came back in, he wouldn’t get the carpets dirty. If it was raining, my mother insisted I dress Cisco in a ridiculous yellow raincoat, but, in my opinion, it was an unnecessary source of humiliation for poor Cisco. It didn’t take long for Cisco to decide that his outerwear could be used as toys in a game of Keep Away. As soon as I took off one of his shoes, he would run away with it, hiding under the bed where I couldn’t reach him. But, he seemed to appreciate his ensemble more when we had to walk through snowdrifts to get his job done.

When my abuela was dying from cancer, we went in the middle of the night to see her before she passed. I was sad and scared. But, my dad let me take Cisco in the car, so Cisco cuddled with me and made me feel much better. It’s like he could read my mind. Once we arrived at the hospital, the fluorescent lighting made the entire scene seem unreal, as if I was watching the scene unfold through someone else’s eyes. My grandma lay calmly on her bed, smiling at us even through her last moments of pain. I disliked seeing the tubes and machines hooked up to her. It was unnatural to see her like this一it was so unlike the way I usually saw her beautiful in her flowery dress, whistling a Billie Holiday tune and baking snickerdoodle cookies in the kitchen. The hospital didn’t usually allow dogs, but they made a special exception to respect my grandma’s last wishes that the whole family be together. Cisco remained at the foot of the bed, intently watching abuela with a silence that seemed more effective at communicating comfort and compassion than the rest of us who attempted to offer up words of comfort that just seemed hollow and insincere. It was then that I truly appreciated Cisco’s empathy for others.

As I accompanied my dad to pick up our dry cleaner’s from Ms. Chapman, a family friend asked, “How’s Cisco?” before even asking about my sisters or me. Cisco is the Villanova family mascot, a Goldendoodle better recognized by strangers throughout Loveland than the individual members of my family.

On our summer trip to Boyd Lake State Park, we stayed at the Cottonwood campground for a breathtaking view of the lake. Cisco was allowed to come, but we had to keep him on a leash at all times. After a satisfying meal of fish, our entire family walked along the beach. Cisco and I led the way while my mom and sisters shuffled behind. Cisco always stopped and refused to move, looking back to make sure the others were still following. Once satisfied that everyone was together, he would turn back around and continue prancing with his golden boy curly locks waving in the chilly wind.

On the beach, Cisco “accidentally” got let off his leash and went running maniacally around the sand, unfettered and free. His pure joy as he raced through the sand made me forget about my AP Chem exam or my student council responsibilities. He brings a smile not only to my family members but everyone around him.

Cisco won’t live forever, but without words, he has impressed upon me life lessons of responsibility, compassion, loyalty, and joy. I can’t imagine life without him.

Word count: 701

I quickly figured out that as “the chosen one,” I had been enlisted by Cisco to oversee all aspects of his “business.” I learned to put on Cisco’s doggie shoes to keep the carpet clean before taking him out一no matter the weather. Soon after, Cisco decided that his shoes could be used as toys in a game of Keep Away. As soon as I removed one of his shoes, he would run away with it, hiding under the bed where I couldn’t reach him. But, he seemed to appreciate his footwear more after I’d gear him up and we’d tread through the snow for his daily walks.

One morning, it was 7:15 a.m., and Alejandro was late again to pick me up. “Cisco, you don’t think he overslept again, do you?” Cisco barked, as if saying, “Of course he did!” A text message would never do, so I called his dad, even if it was going to get him in trouble. There was no use in both of us getting another tardy during our first-period class, especially since I was ready on time after taking Cisco for his morning outing. Alejandro was mad at me but not too much. He knew I had helped him out, even if he had to endure his dad’s lecture on punctuality.

Another early morning, I heard my sister yell, “Mom! Where are my good ballet flats? I can’t find them anywhere!” I hesitated and then confessed, “I moved them.” She shrieked at me in disbelief, but I continued, “I put them in your closet, so Cisco wouldn’t chew them up.” More disbelief. However, this time, there was silence instead of shrieking.

Last spring, Cisco and I were fast asleep when the phone rang at midnight. Abuela would not make it through the night after a long year of chemo, but she was in Pueblo, almost three hours away. Sitting next to me for that long car ride on I-25 in pitch-black darkness, Cisco knew exactly what I needed and snuggled right next to me as I petted his coat in a rhythm while tears streamed down my face. The hospital didn’t usually allow dogs, but they made a special exception to respect my grandma’s last wishes that the whole family be together. Cisco remained sitting at the foot of the hospital bed, intently watching abuela with a silence that communicated more comfort than our hollow words. Since then, whenever I sense someone is upset, I sit in silence with them or listen to their words, just like Cisco did.

The other day, one of my friends told me, “You’re a strange one, Josue. You’re not like everybody else but in a good way.” I didn’t know what he meant at first. “You know, you’re super responsible and grown-up. You look out for us instead of yourself. Nobody else does that.” I was a bit surprised because I wasn’t trying to do anything different. I was just being me. But then I realized who had taught me: a fluffy little puppy who I had wished was a cat! I didn’t choose Cisco, but he certainly chose me and, unexpectedly, became my teacher, mentor, and friend.

Word count: 617

If you want to know more about academic writing , effective communication , or parts of speech , make sure to check out some of our other articles with explanations and examples.

Academic writing

- Writing process

- Transition words

- Passive voice

- Paraphrasing

Communication

- How to end an email

- Ms, mrs, miss

- How to start an email

- I hope this email finds you well

- Hope you are doing well

Parts of speech

- Personal pronouns

- Conjunctions

A standout college essay has several key ingredients:

- A unique, personally meaningful topic

- A memorable introduction with vivid imagery or an intriguing hook

- Specific stories and language that show instead of telling

- Vulnerability that’s authentic but not aimed at soliciting sympathy

- Clear writing in an appropriate style and tone

- A conclusion that offers deep insight or a creative ending

There are no set rules for how to structure a college application essay , but these are two common structures that work:

- A montage structure, a series of vignettes with a common theme.

- A narrative structure, a single story that shows your personal growth or how you overcame a challenge.

Avoid the five-paragraph essay structure that you learned in high school.

Though admissions officers are interested in hearing your story, they’re also interested in how you tell it. An exceptionally written essay will differentiate you from other applicants, meaning that admissions officers will spend more time reading it.

You can use literary devices to catch your reader’s attention and enrich your storytelling; however, focus on using just a few devices well, rather than trying to use as many as possible.

Most importantly, your essay should be about you , not another person or thing. An insightful college admissions essay requires deep self-reflection, authenticity, and a balance between confidence and vulnerability.

Your essay shouldn’t be a résumé of your experiences but instead should tell a story that demonstrates your most important values and qualities.

When revising your college essay , first check for big-picture issues regarding message, flow, tone, style , and clarity. Then, focus on eliminating grammar and punctuation errors.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Courault, K. (2023, August 14). College Essay Examples | What Works and What Doesn't. Scribbr. Retrieved July 10, 2024, from https://www.scribbr.com/college-essay/college-essay-examples/

Is this article helpful?

Kirsten Courault

Other students also liked, choosing your college essay topic | ideas & examples, how to make your college essay stand out | tips & examples, how to revise your college admissions essay | examples, get unlimited documents corrected.

✔ Free APA citation check included ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

Celebrating 150 years of Harvard Summer School. Learn about our history.

12 Strategies to Writing the Perfect College Essay

College admission committees sift through thousands of college essays each year. Here’s how to make yours stand out.

Pamela Reynolds

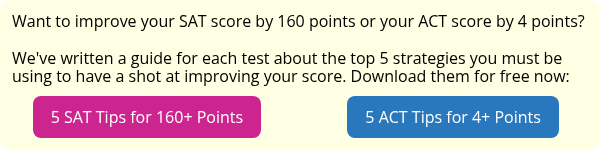

When it comes to deciding who they will admit into their programs, colleges consider many criteria, including high school grades, extracurricular activities, and ACT and SAT scores. But in recent years, more colleges are no longer considering test scores.

Instead, many (including Harvard through 2026) are opting for “test-blind” admission policies that give more weight to other elements in a college application. This policy change is seen as fairer to students who don’t have the means or access to testing, or who suffer from test anxiety.

So, what does this mean for you?

Simply that your college essay, traditionally a requirement of any college application, is more important than ever.

A college essay is your unique opportunity to introduce yourself to admissions committees who must comb through thousands of applications each year. It is your chance to stand out as someone worthy of a seat in that classroom.

A well-written and thoughtful essay—reflecting who you are and what you believe—can go a long way to separating your application from the slew of forgettable ones that admissions officers read. Indeed, officers may rely on them even more now that many colleges are not considering test scores.

Below we’ll discuss a few strategies you can use to help your essay stand out from the pack. We’ll touch on how to start your essay, what you should write for your college essay, and elements that make for a great college essay.

Be Authentic

More than any other consideration, you should choose a topic or point of view that is consistent with who you truly are.

Readers can sense when writers are inauthentic.

Inauthenticity could mean the use of overly flowery language that no one would ever use in conversation, or it could mean choosing an inconsequential topic that reveals very little about who you are.

Use your own voice, sense of humor, and a natural way of speaking.

Whatever subject you choose, make sure it’s something that’s genuinely important to you and not a subject you’ve chosen just to impress. You can write about a specific experience, hobby, or personality quirk that illustrates your strengths, but also feel free to write about your weaknesses.

Honesty about traits, situations, or a childhood background that you are working to improve may resonate with the reader more strongly than a glib victory speech.

Grab the Reader From the Start

You’ll be competing with so many other applicants for an admission officer’s attention.

Therefore, start your essay with an opening sentence or paragraph that immediately seizes the imagination. This might be a bold statement, a thoughtful quote, a question you pose, or a descriptive scene.

Starting your essay in a powerful way with a clear thesis statement can often help you along in the writing process. If your task is to tell a good story, a bold beginning can be a natural prelude to getting there, serving as a roadmap, engaging the reader from the start, and presenting the purpose of your writing.

Focus on Deeper Themes

Some essay writers think they will impress committees by loading an essay with facts, figures, and descriptions of activities, like wins in sports or descriptions of volunteer work. But that’s not the point.

College admissions officers are interested in learning more about who you are as a person and what makes you tick.

They want to know what has brought you to this stage in life. They want to read about realizations you may have come to through adversity as well as your successes, not just about how many games you won while on the soccer team or how many people you served at a soup kitchen.

Let the reader know how winning the soccer game helped you develop as a person, friend, family member, or leader. Make a connection with your soup kitchen volunteerism and how it may have inspired your educational journey and future aspirations. What did you discover about yourself?

Show Don’t Tell

As you expand on whatever theme you’ve decided to explore in your essay, remember to show, don’t tell.

The most engaging writing “shows” by setting scenes and providing anecdotes, rather than just providing a list of accomplishments and activities.

Reciting a list of activities is also boring. An admissions officer will want to know about the arc of your emotional journey too.

Try Doing Something Different

If you want your essay to stand out, think about approaching your subject from an entirely new perspective. While many students might choose to write about their wins, for instance, what if you wrote an essay about what you learned from all your losses?

If you are an especially talented writer, you might play with the element of surprise by crafting an essay that leaves the response to a question to the very last sentence.

You may want to stay away from well-worn themes entirely, like a sports-related obstacle or success, volunteer stories, immigration stories, moving, a summary of personal achievements or overcoming obstacles.

However, such themes are popular for a reason. They represent the totality of most people’s lives coming out of high school. Therefore, it may be less important to stay away from these topics than to take a fresh approach.

Explore Harvard Summer School’s College Programs for High School Students

Write With the Reader in Mind

Writing for the reader means building a clear and logical argument in which one thought flows naturally from another.

Use transitions between paragraphs.

Think about any information you may have left out that the reader may need to know. Are there ideas you have included that do not help illustrate your theme?

Be sure you can answer questions such as: Does what you have written make sense? Is the essay organized? Does the opening grab the reader? Is there a strong ending? Have you given enough background information? Is it wordy?

Write Several Drafts

Set your essay aside for a few days and come back to it after you’ve had some time to forget what you’ve written. Often, you’ll discover you have a whole new perspective that enhances your ability to make revisions.

Start writing months before your essay is due to give yourself enough time to write multiple drafts. A good time to start could be as early as the summer before your senior year when homework and extracurricular activities take up less time.

Read It Aloud

Writer’s tip : Reading your essay aloud can instantly uncover passages that sound clumsy, long-winded, or false.

Don’t Repeat

If you’ve mentioned an activity, story, or anecdote in some other part of your application, don’t repeat it again in your essay.

Your essay should tell college admissions officers something new. Whatever you write in your essay should be in philosophical alignment with the rest of your application.

Also, be sure you’ve answered whatever question or prompt may have been posed to you at the outset.

Ask Others to Read Your Essay

Be sure the people you ask to read your essay represent different demographic groups—a teacher, a parent, even a younger sister or brother.

Ask each reader what they took from the essay and listen closely to what they have to say. If anyone expresses confusion, revise until the confusion is cleared up.

Pay Attention to Form

Although there are often no strict word limits for college essays, most essays are shorter rather than longer. Common App, which students can use to submit to multiple colleges, suggests that essays stay at about 650 words.

“While we won’t as a rule stop reading after 650 words, we cannot promise that an overly wordy essay will hold our attention for as long as you’d hoped it would,” the Common App website states.

In reviewing other technical aspects of your essay, be sure that the font is readable, that the margins are properly spaced, that any dialogue is set off properly, and that there is enough spacing at the top. Your essay should look clean and inviting to readers.

End Your Essay With a “Kicker”

In journalism, a kicker is the last punchy line, paragraph, or section that brings everything together.

It provides a lasting impression that leaves the reader satisfied and impressed by the points you have artfully woven throughout your piece.

So, here’s our kicker: Be concise and coherent, engage in honest self-reflection, and include vivid details and anecdotes that deftly illustrate your point.

While writing a fantastic essay may not guarantee you get selected, it can tip the balance in your favor if admissions officers are considering a candidate with a similar GPA and background.

Write, revise, revise again, and good luck!

Experience life on a college campus. Spend your summer at Harvard.

Explore Harvard Summer School’s College Programs for High School Students.

About the Author

Pamela Reynolds is a Boston-area feature writer and editor whose work appears in numerous publications. She is the author of “Revamp: A Memoir of Travel and Obsessive Renovation.”

How Involved Should Parents and Guardians Be in High School Student College Applications and Admissions?

There are several ways parents can lend support to their children during the college application process. Here's how to get the ball rolling.

Harvard Division of Continuing Education

The Division of Continuing Education (DCE) at Harvard University is dedicated to bringing rigorous academics and innovative teaching capabilities to those seeking to improve their lives through education. We make Harvard education accessible to lifelong learners from high school to retirement.

Essay Papers Writing Online

A comprehensive guide to essay writing.

Essay writing is a crucial skill that students need to master in order to succeed academically. Whether you’re a high school student working on a history paper or a college student tackling a critical analysis essay, having a solid understanding of the essay writing process is essential.

In this comprehensive guide, we’ll explore the essential tips and tricks that will help you improve your essay writing skills. From generating ideas and organizing your thoughts to crafting a strong thesis statement and polishing your final draft, we’ve got you covered.

Not only that, but we’ll also provide you with useful templates that you can use as a framework for your essays. These templates will help you structure your writing, stay focused on your main argument, and ensure that your essay flows smoothly from one point to the next.

The Ultimate Essay Writing Guides

Essay writing can be a challenging task for many students, but with the right guidance and tips, you can improve your writing skills and produce high-quality essays. In this ultimate guide, we will provide you with valuable advice, tricks, and templates to help you excel in your essay writing endeavors.

1. Understand the Prompt: Before you start writing your essay, make sure you fully understand the prompt or question. Analyze the requirements and key points that need to be addressed in your essay.

2. Create an Outline: Organize your ideas and thoughts by creating a detailed outline for your essay. This will help you structure your arguments and ensure a logical flow of information.

3. Research Thoroughly: Conduct extensive research on your topic to gather relevant information and evidence to support your arguments. Use credible sources and cite them properly in your essay.

4. Write Clearly and Concisely: Avoid using jargon or complex language in your essay. Write in a clear and concise manner to convey your ideas effectively to the reader.

5. Proofread and Edit: Before submitting your essay, make sure to proofread and edit it carefully. Check for grammatical errors, spelling mistakes, and ensure that your essay flows cohesively.

By following these ultimate essay writing guides, you can enhance your writing skills and produce outstanding essays that will impress your instructors and peers. Practice regularly and seek feedback to continuously improve your writing abilities.

Tips for Crafting an A+ Essay

1. Understand the Assignment: Before you start writing, make sure you fully understand the assignment guidelines and requirements. If you have any doubts, clarify them with your instructor.

2. Conduct Thorough Research: Gather relevant sources and information to support your arguments. Make sure to cite your sources properly and use credible sources.

3. Create a Strong Thesis Statement: Your thesis statement should clearly outline the main point of your essay and guide your readers on what to expect.

4. Organize Your Ideas: Create an outline to organize your thoughts and ensure a logical flow of ideas in your essay.

5. Write Clearly and Concisely: Use clear, concise language and avoid unnecessary jargon or complex sentences. Be direct and to the point.

6. Revise and Edit: Always proofread your essay for grammar and spelling errors. Revise your work to ensure coherence and clarity.

7. Seek Feedback: Ask a peer or instructor to review your essay and provide constructive feedback for improvement.

8. Use Proper Formatting: Follow the formatting guidelines provided by your instructor, such as font size, margins, and citation style.

9. Stay Focused: Keep your essay focused on the main topic and avoid going off on tangents. Stick to your thesis statement.

10. Practice, Practice, Practice: The more you practice writing essays, the better you will get at it. Keep practicing and refining your writing skills.

Tricks to Improve Your Writing Skills

Improving your writing skills can be a challenging but rewarding process. Here are some tricks to help you become a better writer:

1. Read widely: Reading a variety of genres and styles can help you develop your own voice and writing style.

2. Practice regularly: The more you write, the better you will become. Set aside time each day to practice writing.

3. Get feedback: Share your writing with others and ask for constructive criticism. Feedback can help you identify areas for improvement.

4. Study grammar and punctuation: Good writing requires a solid understanding of grammar and punctuation rules. Take the time to study and practice these essential skills.

5. Edit and revise: Writing is a process, and editing is an important part of that process. Take the time to edit and revise your work to improve clarity and coherence.

6. Experiment with different writing techniques: Try experimenting with different writing techniques, such as using metaphors, similes, or descriptive language, to enhance your writing.

7. Stay inspired: Find inspiration in the world around you. Whether it’s nature, art, or literature, draw inspiration from your surroundings to fuel your writing.

By following these tricks and practicing regularly, you can improve your writing skills and become a more confident and effective writer.

Step-by-Step Essay Writing Templates

When it comes to writing an essay, having a clear and structured template can be incredibly helpful. Here are some step-by-step essay writing templates that you can use to guide you through the process:

- Introduction: Start your essay with a hook to grab the reader’s attention. Provide some background information on the topic and end with a thesis statement that outlines the main argument of your essay.

- Body Paragraphs: Each body paragraph should focus on a single point that supports your thesis. Start with a topic sentence that introduces the main idea of the paragraph, provide evidence to support your point, and then analyze the evidence to show how it relates back to your thesis.

- Conclusion: Summarize the main points of your essay and restate your thesis in a new way. Avoid introducing new information in the conclusion and instead focus on tying together all the points you have made throughout the essay.

Expert Advice for Writing Top-Notch Essays

When it comes to writing a top-notch essay, it’s essential to follow expert advice to ensure your work stands out. Here are some key tips to help you elevate your writing:

1. Start with a strong thesis statement that clearly outlines your main argument.

2. Conduct thorough research to support your points with credible sources.

3. Organize your thoughts logically and ensure your essay flows smoothly from one point to the next.

4. Use a variety of sentence structures and vocabulary to keep your writing engaging.

5. Proofread and edit your essay carefully to eliminate errors and refine your arguments.

By following these expert tips, you can take your essay writing skills to the next level and produce work that is both informative and compelling.

Resources to Enhance Your Essay Writing Process

When it comes to improving your essay writing skills, there are a variety of resources available to help you enhance your process. Here are some valuable resources that can aid you in becoming a more effective and efficient writer:

- Writing Guides: There are countless writing guides and books that offer tips, tricks, and strategies for improving your writing skills. Whether you’re looking to enhance your grammar, structure, or argumentation, these guides can provide valuable insights.

- Online Writing Communities: Joining online writing communities can be a great way to connect with other writers, receive feedback on your work, and engage in writing challenges and prompts. Websites like Writing.com and Wattpad are popular platforms for writers to share their work and receive critiques.

- Writing Workshops and Courses: Participating in writing workshops and courses can help you hone your craft and develop your writing skills. Whether you prefer in-person workshops or online courses, there are many options available to suit your needs and schedule.

- Writing Apps and Tools: Utilizing writing apps and tools can streamline your writing process and help you stay organized. Tools like Grammarly can assist with grammar and spelling checks, while apps like Scrivener can help you organize your research and ideas.

- Libraries and Writing Centers: Visiting your local library or university writing center can provide access to valuable resources, such as writing guides, research materials, and writing tutors who can offer personalized feedback and support.

By taking advantage of these resources, you can enhance your essay writing process and become a more skilled and confident writer.

Related Post

How to master the art of writing expository essays and captivate your audience, step-by-step guide to crafting a powerful literary analysis essay, convenient and reliable source to purchase college essays online, unlock success with a comprehensive business research paper example guide, unlock your writing potential with writers college – transform your passion into profession, “unlocking the secrets of academic success – navigating the world of research papers in college”, master the art of sociological expression – elevate your writing skills in sociology.

How to Write a College Essay: The Ultimate Step-by-Step Guide

One way to think of your college essay is as the heart of your application—as in, it helps an admissions officer see who you are, what you value, and what you bring to their campus and community.

And before we talk you through how to write your college essay, we want to acknowledge something fairly strange about this process: namely, that this is a kind of writing that you’ve maybe never been asked to do before.

In that sense, college essays are a bizarre bait-and-switch—in high school, you’re taught a few different ways to write (e.g., maybe some historical analysis, or how to analyze literature, or creative writing), and then to apply to college, you’re asked to write something fairly different (or maybe completely different) from any of the things you’ve been asked to write in high school.

So first we’ll talk you through

the purpose of your college essay

and the degree to which it is important in your application (preview: it won’t be as important for some people as for others)

and then we’ll walk you step-by-step through how to write an essay that can help you stand out in the application process.

Let’s dive in.

TABLE OF CONTENTS

Brainstorming your college essay topic, how to structure & outline a college essay, the difference between a boring and a stand-out personal statement.

- A quick word on “common” or “cliché” topics

- The “home” essay: a quick college essay case study

- Five (more) ways to find a thematic thread for your personal statement

- Montage essay structure FAQ’s

- Narrative essay structure FAQ’s

How to write a college essay: understanding what it is and how important it can be

What’s the purpose of your college essay (aka the personal statement).

This is your main essay. Your application centerpiece. The part of your application you’re likely to spend the most time on.

Assuming you’re applying via the Common App (here’s our how-to guide for that), the personal statement is likely to be 500-650 words long (so about a page) and many of the colleges you’re applying to will require it. (If you’re applying to the UCs, you’ll need to write some totally different essays .)

What’s a college essay’s purpose?

Jennifer Blask, Executive Director for International Admissions at the University of Rochester, puts it beautifully: “So much of the college application is a recounting of things past—past grades, old classes, activities the student has participated in over several years. The essay is a chance for the student to share who they are now and what they will bring to our campus communities.”

Basically, college admission officers are looking for three takeaways in your college essay:

Who is this person?

Will this person contribute something of value to our campus?

Can this person write?

If you want to dig deeper into how admissions officers are thinking during the admissions process , or into what colleges look for in students , check out those two guides.

How important is your college essay?

That really depends on a lot of factors, but two of the biggest are the schools you’re applying to, and your academic profile. Here’s one way to think of the importance of essays:

Essays are less important if

You’re applying to “selective” colleges (around a 15-50% acceptance rate) and your academic profile is stronger than other applicants’

You’re applying in-state to large colleges, and/or to less competitive programs (e.g. you live in Sacramento and are applying to UC Riverside as an English major)

Essays are more important if

You’re applying to “highly-selective” aka “highly rejective”) colleges, meaning they have a less than 15% acceptance rate

You’re applying to “selective” colleges (around a 15-50% acceptance rate) but your academic profile isn’t as strong as other applicants’

You’re applying to really competitive programs (for example, engineering and computer science at some schools have way, way more applicants than spots) and/or you’re applying out-of-state to a state school system (e.g. you live in Montana and want to go to school at the University of Washington, and/or you want to study CS at UW).

To illustrate further—CEG’s Tom Campbell, who used to be an Assistant Dean of Admissions at Pomona , puts it this way: around 80% of the applicants to Pomona in a given year when he worked there were academically admissible. Meaning at schools like Pomona (with its 7ish% acceptance rate), grades and test scores don’t really get you in—they just get your foot in the door.

And an important thing to understand on that last note: if you get rejected from the “highly rejective” schools, it will tend to have a lot more to do with things like institutional priorities —some things in this process are out of your control.

Below are the five exercises I have every student complete before I meet with them:

Essence Objects Exercise : 12 min.

Values Exercise : 4 min.

21 Details Exercise : 20 min.

Everything I Want Colleges to Know About Me Exercise : 20 min.

The Feelings and Needs Exercise : 15-20 min.

I recommend recording all the content from your exercises in one document to keep things neat. If you’ve been working as you go, you’ve already completed these, so make sure to do this step now. You can use our downloadable Google doc with these exercises if you’d like.

At the start of the essay process, I ask students two questions:

Have you faced significant challenges in your life?

Do you want to write about them?

Because here’s an important qualifier:

Even if you’ve faced challenges, you do not have to write about them in your personal statement.

I mention this now because, in my experience, many students are under the impression that they have to write about challenges—that it’s either expected, or that it’s somehow better to do so.

Neither is true. (And to be sure it’s clear: you do not have to write about trauma in your college essay to stand out .)

I’ve seen many, many incredible essays—ones that got students into every school you’re hoping to get into—that had no central challenge.

If your answer is “Maybe … ?” because you’re not sure what qualifies as a challenge, it’s useful to think of challenges as being on a spectrum.

On the weaker end of the spectrum would be things like getting a bad grade or not making X sports team. On the strong end of the spectrum would be things like escaping war. Being extremely shy but being responsible for translating for your family might be around a 3 or 4 out of 10. (Check this out if you want to read more about college essay topics to maybe avoid .)

It’s possible to use Narrative Structure to write about a challenge anywhere on the spectrum, but it’s much, much harder to write an outstanding essay about a weaker challenge.

Sometimes students pick the hardest challenge they’ve been through and try to make it sound worse than it actually was. Beware of pushing yourself to write about a challenge merely because you think these types of essays are inherently “better.” Focusing myopically on one experience can sideline other brilliant and beautiful elements of your character.

If you’re still uncertain, don’t worry. I’ll help you decide what to focus on. But, for the sake of this blog post, answer those first two questions with a gut-level response.

| 1. Challenges? | Yes/No | |

| 2. Vision for your future? | Yes/No |

In the sections that follow, I’ll introduce you to two structures: Narrative Structure, which works well for describing challenges, and Montage Structure, which works well for essays that aren’t about challenges.

Heads-up: Some students who have faced challenges find after reading that they prefer Montage Structure to Narrative Structure. Or vice versa. If you’re uncertain which approach is best for you, I generally recommend experimenting with montage first; you can always go back and play with narrative.

How to write a college essay using montage structure

A montage is, simply put, a series of moments or story events connected by a common thematic thread.

Well-known examples from movies include “training” montages, like those from Mulan , Rocky , or Footloose , or the “falling in love” montage from most romantic comedies. Or remember the opening to the Pixar movie Up ? In just a few minutes, we learn the entire history of Carl and Ellie’s relationship. One purpose is to communicate a lot of information fast. Another is to allow you to share a lot of different kinds of information, as the example essay below shows.

Narrative Structure vs. Montage Structure explained in two sentences:

In Narrative Structure, story events connect chronologically.

In Montage Structure, story events connect thematically.

Here’s a metaphor to illustrate a montage approach:

Imagine that each different part of you is a bead and that a select few will show up in your essay. They’re not the kind of beads you’d find on a store-bought bracelet; they’re more like the hand-painted beads on a bracelet your little brother made for you.

The theme of your essay is the thread that connects your beads.

You can find a thread in many, many different ways. One way we’ve seen students find great montage threads is by using the 5 Things Exercise . I’ll get detailed on this a little bit later, but essentially, are there 5 thematically connected things that thread together different experiences/moments/events in your life? For example, are there 5 T-shirts you collected, or 5 homes or identities, or 5 entries in your Happiness Spreadsheet .

And to clarify, your essay may end up using only 4 of the 5 things. Or maybe 8. But 5 is a nice number to aim for initially.

Note the huge range of possible essay threads. To illustrate, here are some different “thread” examples that have worked well:

Sports have had a powerful influence on me, from my understanding of history, to numbers, to my relationships, extracurricular activities, and even my career choice.

I lived with 5 different families as an exchange student, and each one taught me something valuable that I’ll carry with me to college.

Crassulaceae plants, which can reproduce via stem or leaf fragments, are a great analogy for not only how I make art, but how I choose to live each day.

Binary star systems are a metaphor for my relationship with my parents.

I am “trans” in so many ways … let me describe a few.

To understand who I am, you must understand how I cook.

Pranks have shaped my life in a variety of ways.

The number 12 has influenced so much in my life, from my relationship to sports, to how I write, to my self-esteem.

All of these threads stemmed from the brainstorming exercises in this post.

We’ll look at an example essay in a minute, but before we do, a word (well, a bunch of words) on how to build a stronger montage (and the basic concept here also applies to building stronger narratives).

Would you Rather watch instead?

To frame how to think about possible college essay topics ... .

Imagine you’re interviewing for a position as a fashion designer, and your interviewer asks you what qualities make you right for this position. Oh, and heads-up: That imaginary interviewer has already interviewed a hundred people today, so you’d best not roll up with, “because I’ve always loved clothes” or “because fashion helps me express my creativity.” Why shouldn’t you say those things? Because that’s what everyone says.

Many students are the same in their personal statements—they name cliché qualities/skills/values and don’t push their reflections much further.

Why is this a bad idea?

Let me frame it this way:

A boring personal statement chooses a common topic, makes common connections, and uses common language.

A stand-out personal statement chooses an un common topic, makes un common connections, and uses un common language.

Boring personal statement: I want to be a doctor (common topic) because I’m empathetic and I love helping people (common connections) and I really want to make the world a better place (common language).

Better personal statement: I want to run a tech-startup (more uncommon topic) because I value humor, “leading from the battlefield,” and stuff that makes me cry (uncommon connections for an essay on this topic), and because my journey to this place took me from being a scrawny 12-year-old kid to a scrawny 12-year-old man (uncommon language).

Important: I’m not saying you should pick a weird topic/thread just so it’ll help you stand out more on your essay. Be honest. But consider this: The more common your topic is ... the more un common your connections need to be if you want to stand out.

What do I mean?

For example, tons of students write doctor/lawyer/engineer essays; if you want to stand out, you need to say a few things that others don’t tend to say.

How do you figure out what to say? By making uncommon connections.

They’re the key to a stand-out essay.

The following two-part exercise will help you do this.

2-minute exercise: Start with the cliché version of your essay.

What would the cliché version of your essay focus on?

If you’re writing a “Why I want to be an engineer” essay, for example, what 3-5 common “engineering” values might other students have mentioned in connection with engineering? Use the Values Exercise for ideas.

Collaboration? Efficiency? Hands-on work? Probably yes to all three.

Once you’ve spent 2 minutes thinking up some common/cliché values, move onto the next step.

8-Minute Exercise: Brainstorm uncommon connections.

For example, if your thread is “food” (which can lead to great essays, but is also a really common topic), push yourself beyond the common value of “health” and strive for unexpected values. How has cooking taught you about “accountability,” for example, or “social change”? Why do this? We’ve already read the essay on how cooking helped the author become more aware of their health. An essay on how cooking allowed the author to become more accountable or socially aware would be less common.

In a minute, we’ll look at the “Laptop Stickers” essay. One thing that author discusses is activism. A typical “activist” essay might discuss public speaking or how the author learned to find their voice. A stand-out essay would go further, demonstrating, say, how a sense of humor supports activism. Perhaps it would describe a childhood community that prioritized culture-creation over culture-consumption, reflecting on how these experiences shaped the author’s political views.

And before you beg me for an “uncommon values” resource, I implore you to use your brilliant brain to dream up these connections. Plus, you aren’t looking for uncommon values in general ; you’re looking for values uncommonly associated with your topic/thread .

Don’t get me wrong ... I’m not saying you shouldn’t list any common values, since some common values may be an important part of your story! In fact, the great essay examples throughout this book sometimes make use of common connections. I’m simply encouraging you to go beyond the obvious.

Also note that a somewhat-common lesson (e.g., “I found my voice”) can still appear in a stand-out essay. But if you choose this path, you’ll likely need to use either an uncommon structure or next-level craft to create a stand-out essay.

Where can you find ideas for uncommon qualities/skills/values?

Here are four places:

1. The Values Exercise

This is basically a huge list of qualities/skills/values that could serve you in a future career.

2. O*Net Online

Go to www.onetonline.org and use the “occupation quick search” feature to search for your career. Once you do, a huge list will appear containing knowledge, skills, and abilities needed for your career. This is one of my favorite resources for this exercise.

3. School websites

Go to a college's website and click on a major or group of majors that interest you. Sometimes they’ll briefly summarize a major in terms of what skills it’ll impart or what jobs it might lead to. Students are often surprised to discover how broadly major-related skills can apply.

4. Real humans

Ask 3 people in this profession what unexpected qualities, values, or skills prepared them for their careers. Please don’t simply use their answers as your own; allow their replies to inspire your brainstorming process.

Once you’ve got a list of, say, 7-10 qualities, move on to the next step.

A quick word on “common” or “cliché” college essay topics

Common personal statement topics include extracurricular activities (sports or musical instruments), service trips to foreign countries (aka the “mission trip” essay where the author realizes their privilege), sports injuries, family illnesses, deaths, divorce, the “meta” essay (e.g., “As I sit down to write my college essays, I think about...”), or someone who inspired you (common mistake: This usually ends up being more about them than you).

While I won’t say you should never write about these topics, if you do decide to write about one of these topics, the degree of difficulty goes way up. What do I mean? Essentially, you have to be one of the best “soccer” essays or “mission trip” essays among the hundreds the admission officer has likely read (and depending on the school, maybe the hundreds they’ve read this year ). So it makes it much more difficult to stand out.

How do you stand out? A cliché is all in how you tell the story. So, if you do choose a common topic, work to make uncommon connections (i.e., offer unexpected narrative turns or connections to values), provide uncommon insights (i.e., say stuff we don’t expect you to say) or uncommon language (i.e., phrase things in a way we haven’t heard before).

Or explore a different topic. You are infinitely complex and imaginative.

Sample montage structure college essay:

My laptop stickers.

My laptop is like a passport. It is plastered with stickers all over the outside, inside, and bottom. Each sticker is a stamp, representing a place I’ve been, a passion I’ve pursued, or community I’ve belonged to. These stickers make for an untraditional first impression at a meeting or presentation, but it’s one I’m proud of. Let me take you on a quick tour: “ We <3 Design ,” bottom left corner. Art has been a constant for me for as long as I can remember. Today my primary engagement with art is through design. I’ve spent entire weekends designing websites and social media graphics for my companies. Design means more to me than just branding and marketing; it gives me the opportunity to experiment with texture, perspective, and contrast, helping me refine my professional style. “ Common Threads ,” bottom right corner. A rectangular black and red sticker displaying the theme of the 2017 TEDxYouth@Austin event. For years I’ve been interested in the street artists and musicians in downtown Austin who are so unapologetically themselves. As a result, I’ve become more open-minded and appreciative of unconventional lifestyles. TED gives me the opportunity to help other youth understand new perspectives, by exposing them to the diversity of Austin where culture is created, not just consumed. Poop emoji , middle right. My 13-year-old brother often sends his messages with the poop emoji ‘echo effect,’ so whenever I open a new message from him, hundreds of poops elegantly cascade across my screen. He brings out my goofy side, but also helps me think rationally when I am overwhelmed. We don’t have the typical “I hate you, don’t talk to me” siblinghood (although occasionally it would be nice to get away from him); we’re each other’s best friends. Or at least he’s mine. “ Lol ur not Harry Styles ,” upper left corner. Bought in seventh grade and transferred from my old laptop, this sticker is torn but persevering with layers of tape. Despite conveying my fangirl-y infatuation with Harry Styles’ boyband, One Direction, for me Styles embodies an artist-activist who uses his privilege for the betterment of society. As a $42K donor to the Time’s Up Legal Defense Fund, a hair donor to the Little Princess Trust, and promoter of LGBTQ+ equality, he has motivated me to be a more public activist instead of internalizing my beliefs. “ Catapult ,” middle right. This is the logo of a startup incubator where I launched my first company, Threading Twine. I learned that business can provide others access to fundamental human needs, such as economic empowerment of minorities and education. In my career, I hope to be a corporate advocate for the empowerment of women, creating large-scale impact and deconstructing institutional boundaries that obstruct women from working in high-level positions. Working as a women’s rights activist will allow me to engage in creating lasting movements for equality, rather than contributing to a cycle that elevates the stances of wealthy individuals. “ Thank God it’s Monday ,” sneakily nestled in the upper right corner. Although I attempt to love all my stickers equally (haha), this is one of my favorites. I always want my association with work to be positive. And there are many others, including the horizontal, yellow stripes of the Human Rights Campaign ; “ The Team ,” a sticker from the Model G20 Economics Summit where I collaborated with youth from around the globe; and stickers from “ Kode with Klossy ,” a community of girls working to promote women’s involvement in underrepresented fields. When my computer dies (hopefully not for another few years), it will be like my passport expiring. It’ll be difficult leaving these moments and memories behind, but I probably won’t want these stickers in my 20s anyways (except Harry Styles, that’s never leaving). My next set of stickers will reveal my next set of aspirations. They hold the key to future paths I will navigate, knowledge I will gain, and connections I will make.

Cool, huh? And see what I mean about how you can write a strong personal statement without focusing on challenges you’ve faced?

Going back to that “thread and beads” metaphor with the “My Laptop Sticker” essay: