Sample Resumes for B.Com Freshers | Download Word Format

Are you a B.Com fresher then your resume will play an important role in getting your first job with a good salary. As a B.Com fresher, you don’t carry any work experience but you have to highlight your skills and knowledge to get more calls from recruiters when you upload your resume to job portals like Naukri, Indeed and Monster, etc.

As a B.Com Fresher do you want to get an Accounting job in top companies like Genpact, Salesforce, or MPhasis, etc.

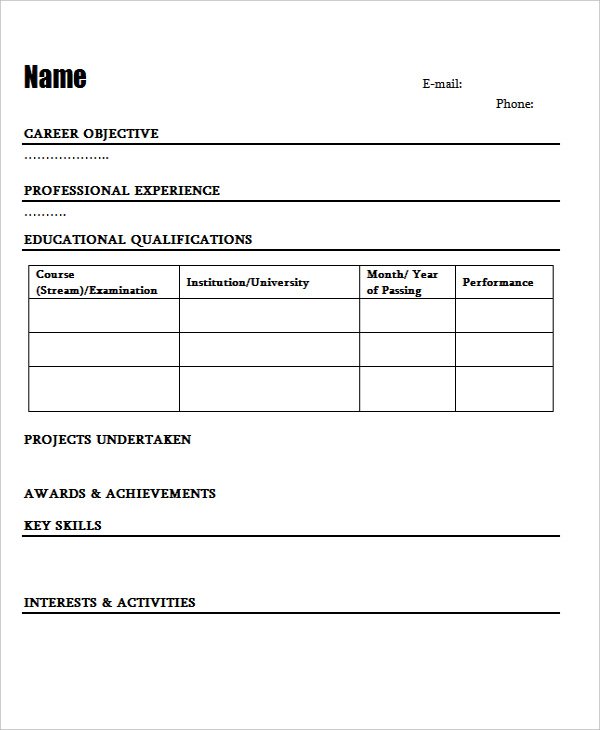

Here are some sample resume formats for B.com students with no experience, you can download them in Word format.

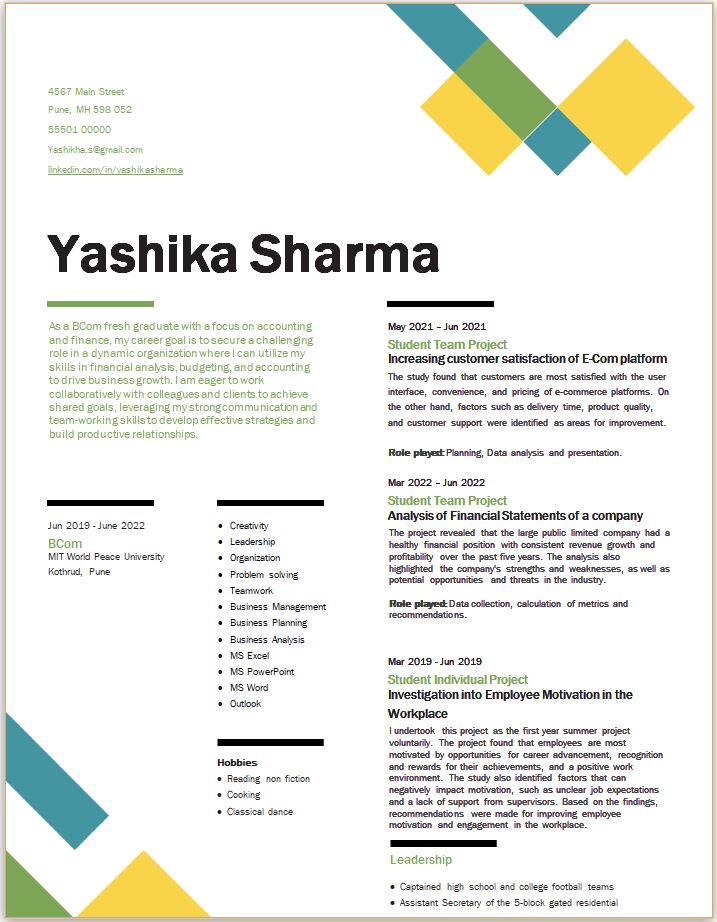

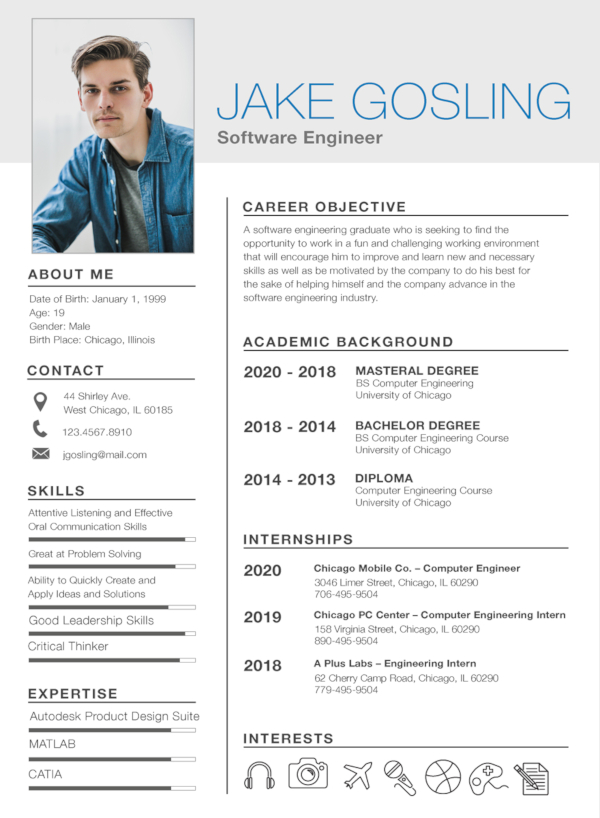

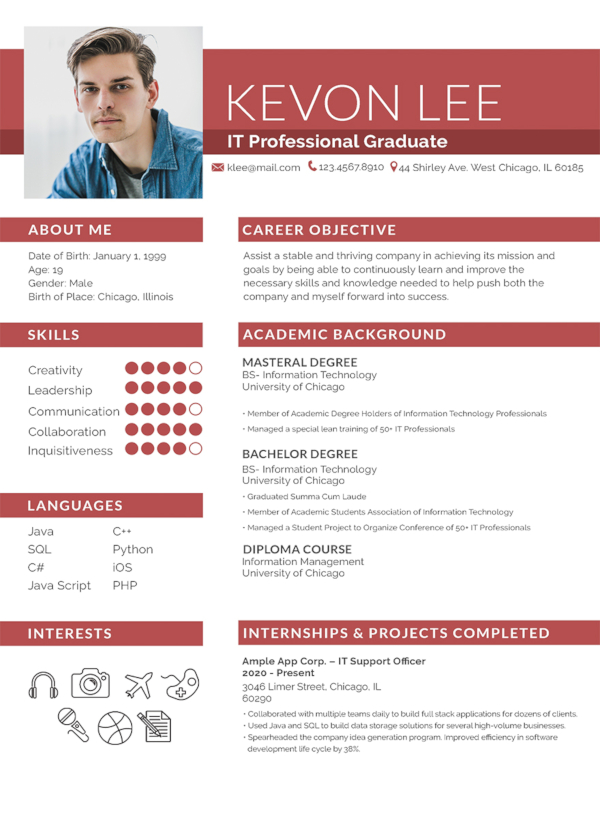

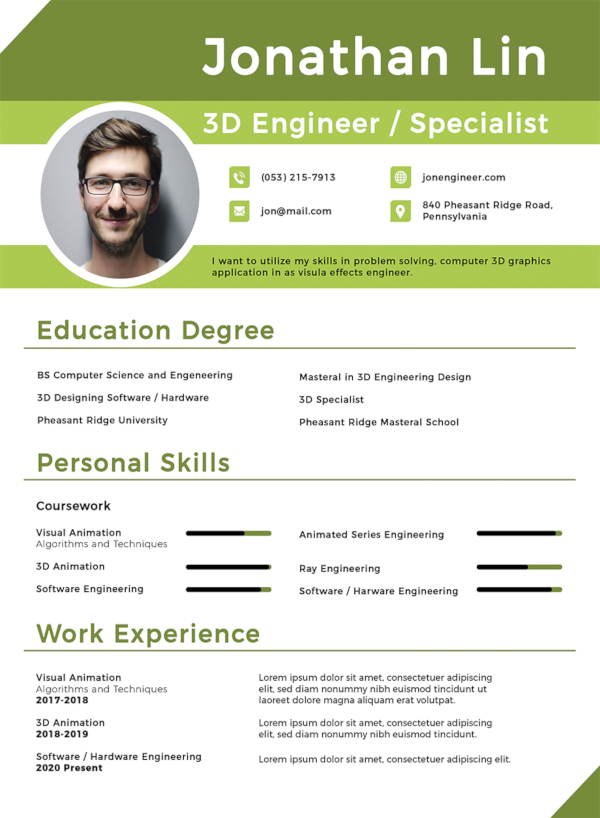

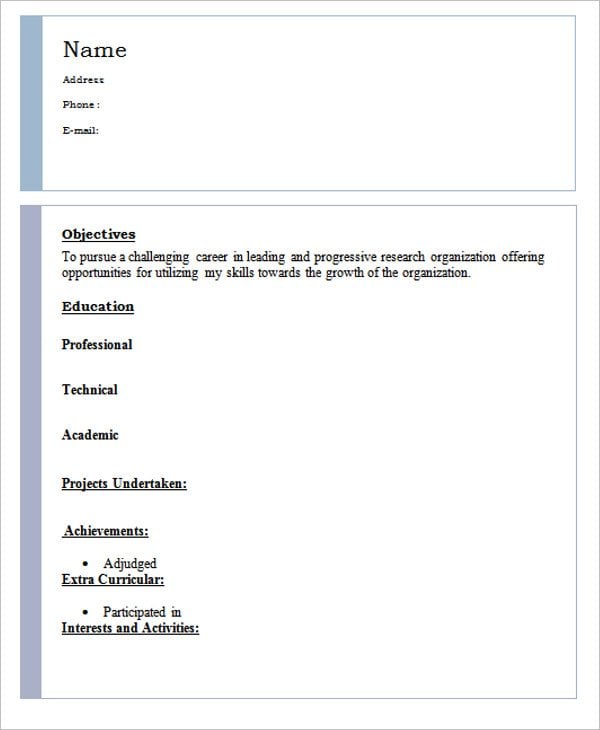

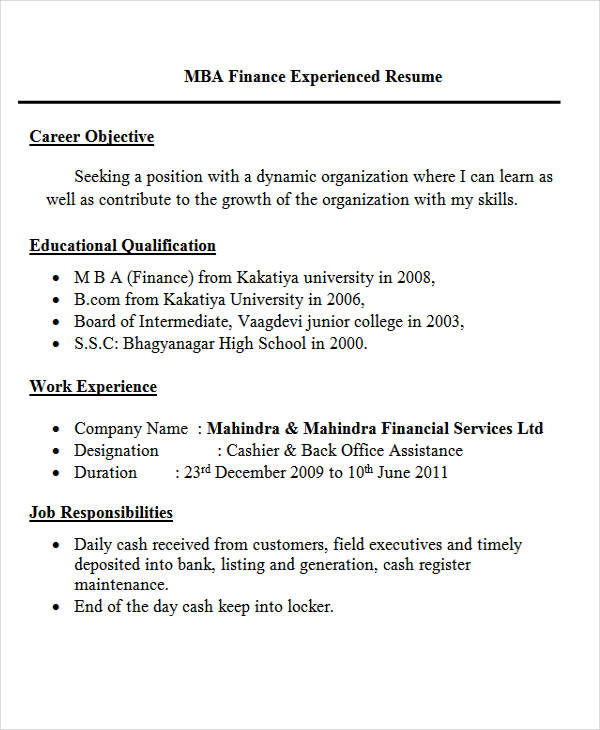

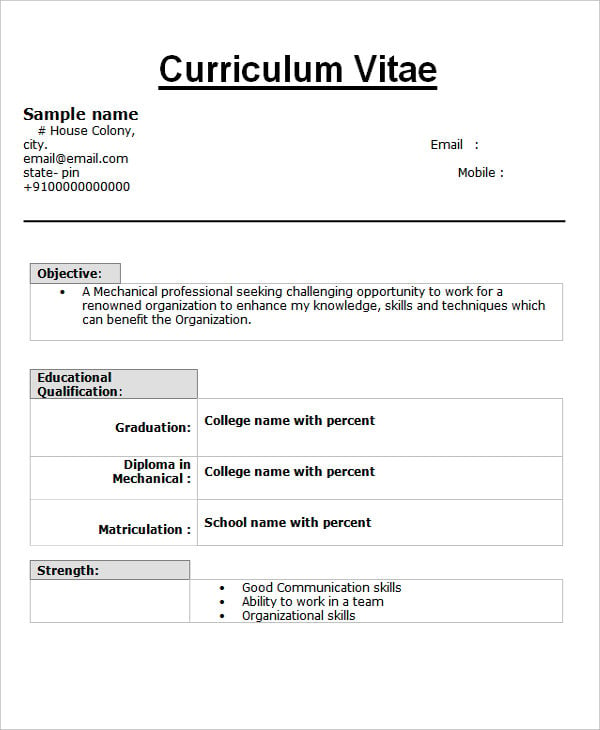

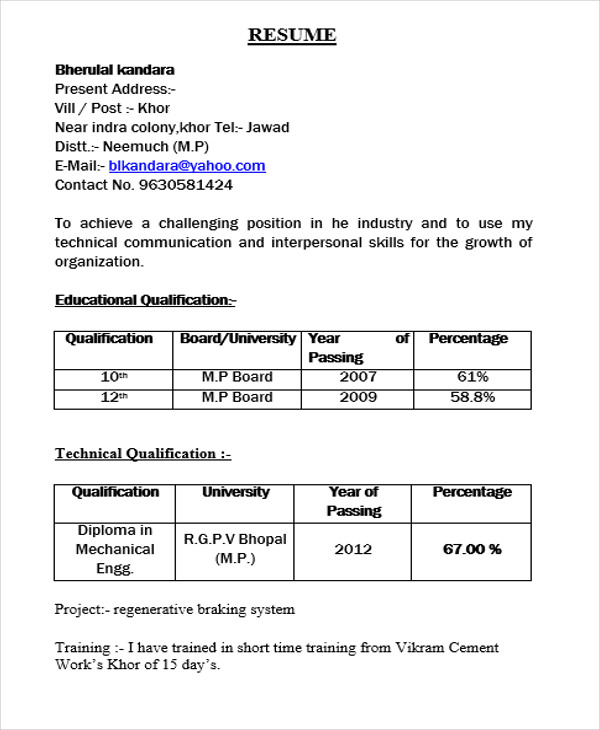

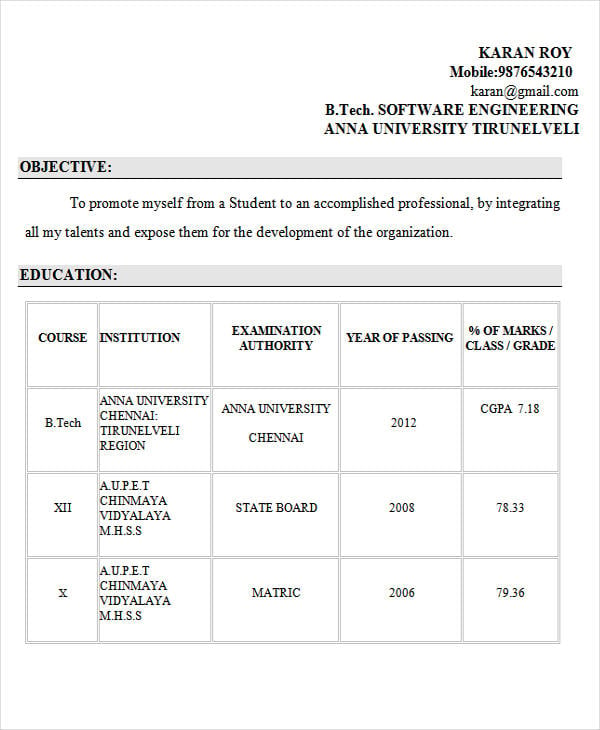

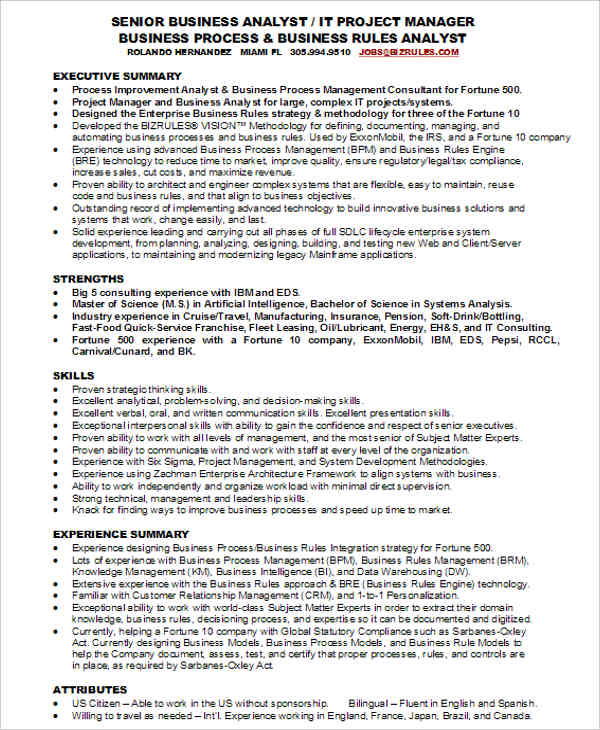

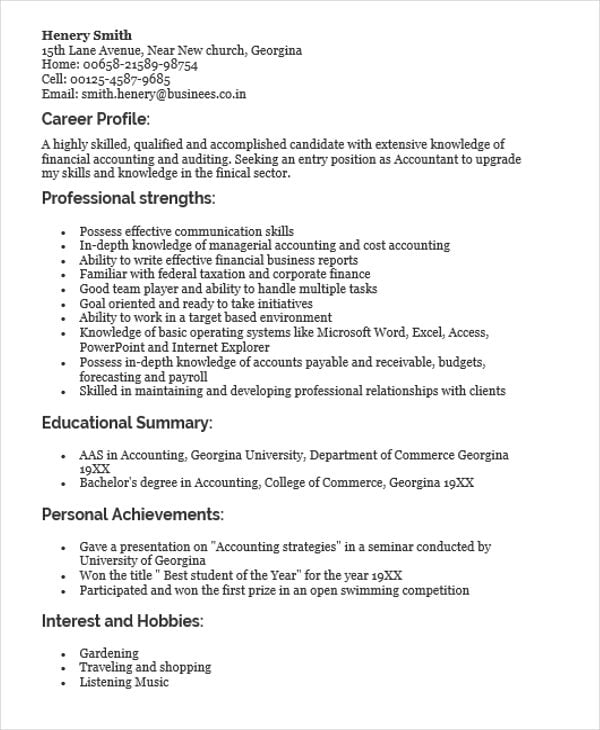

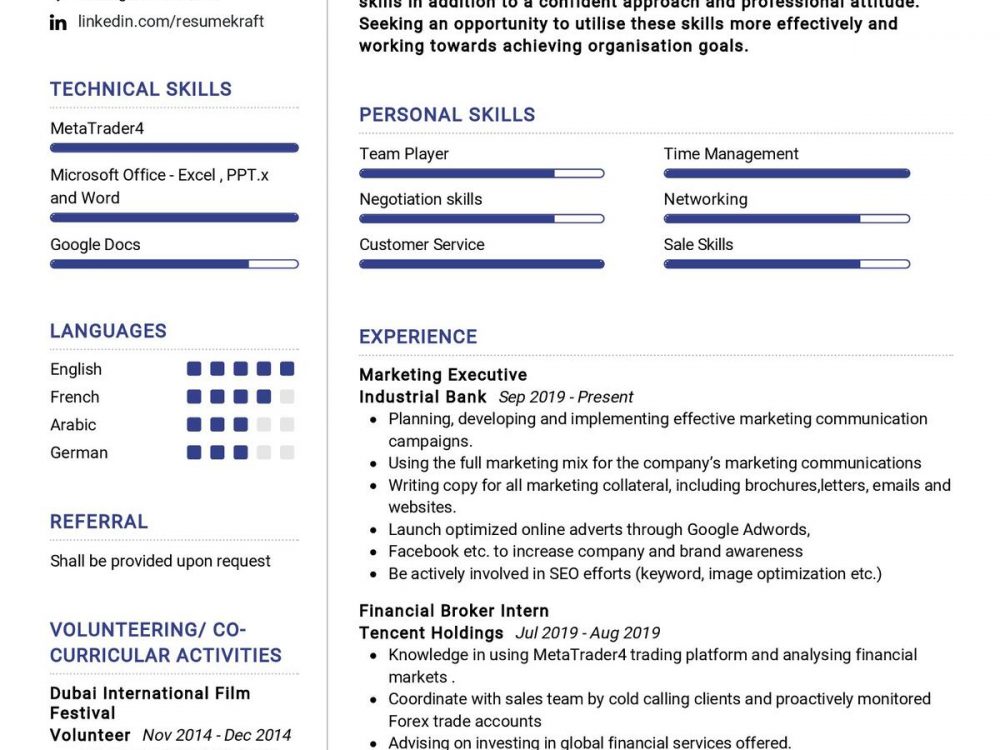

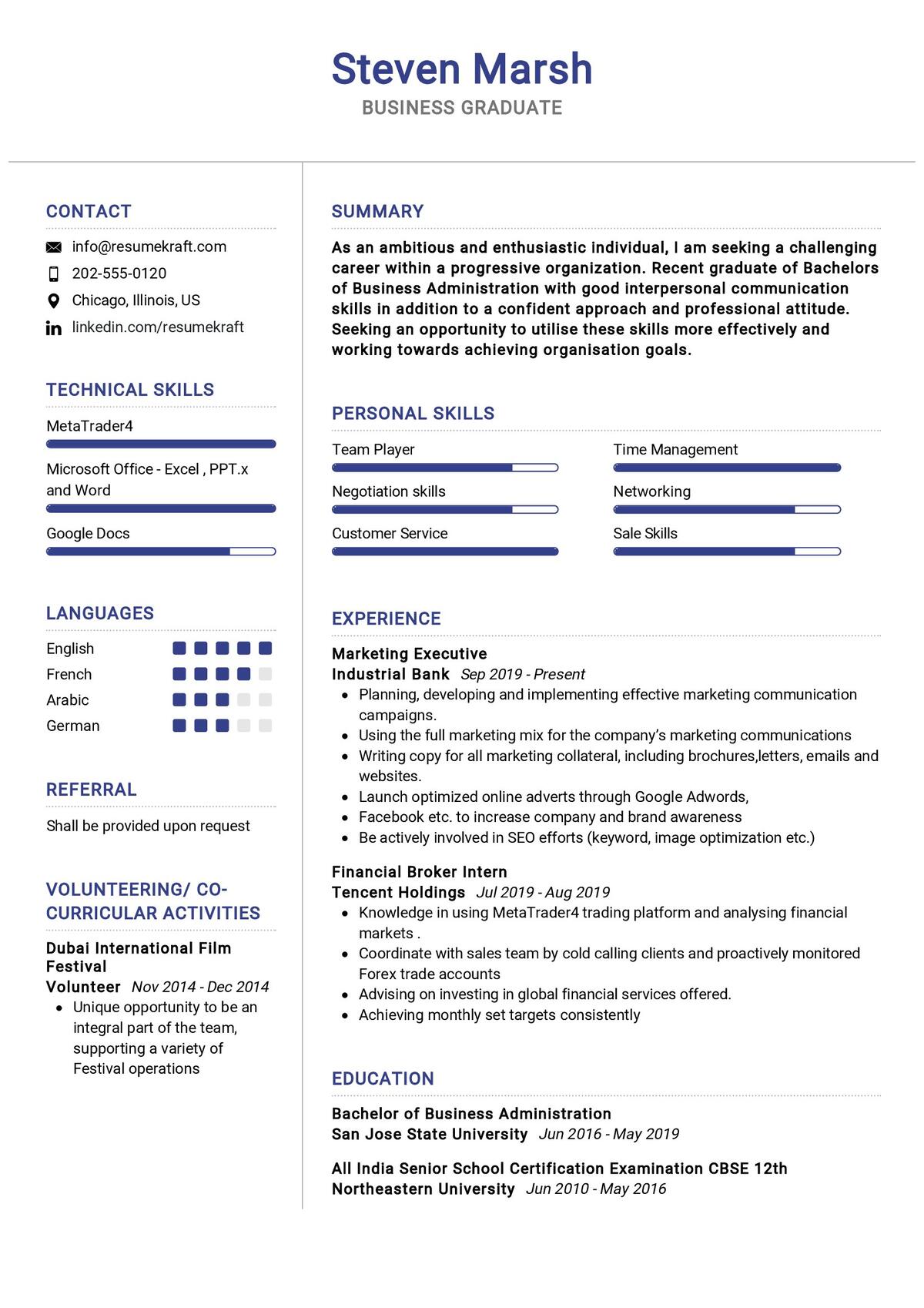

B.Com Fresher Resume Format 1

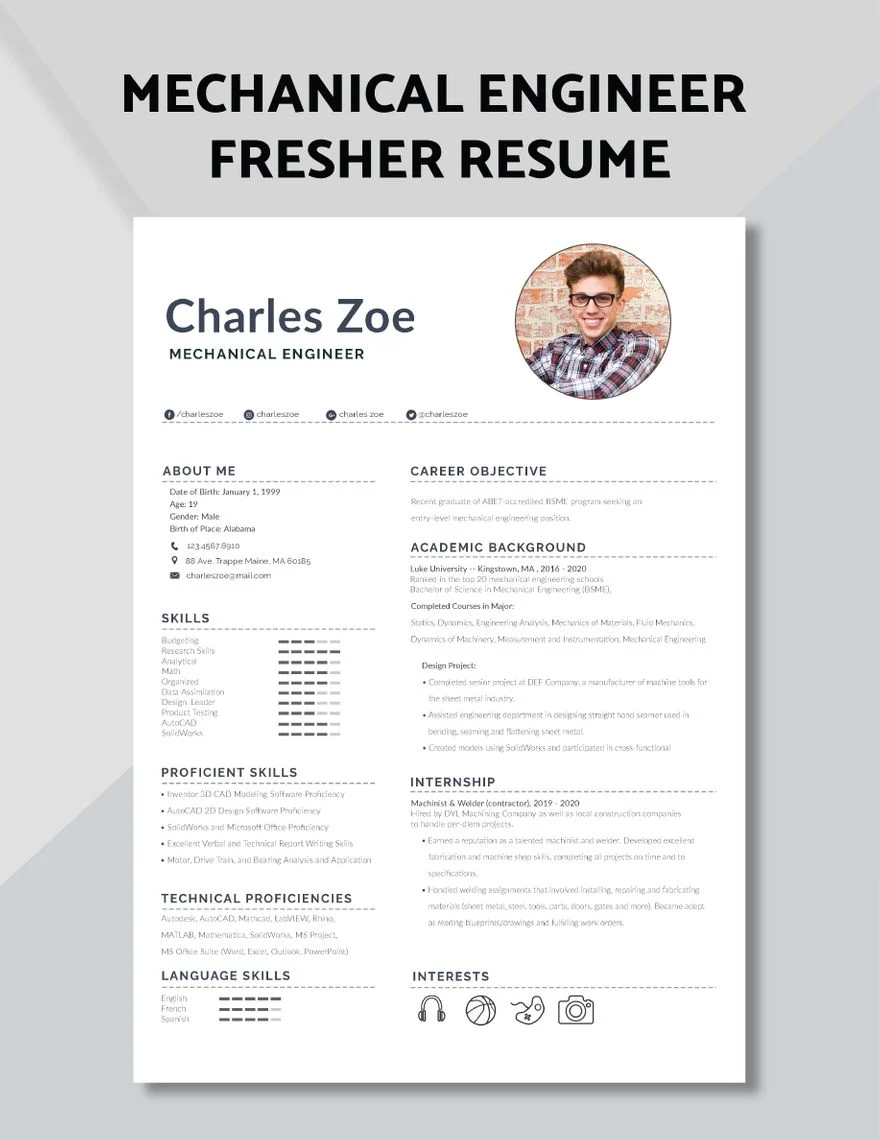

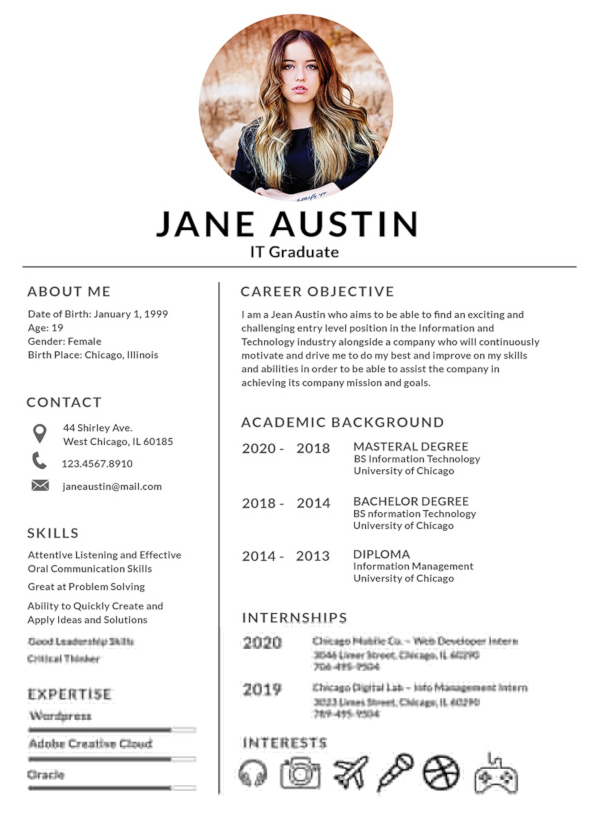

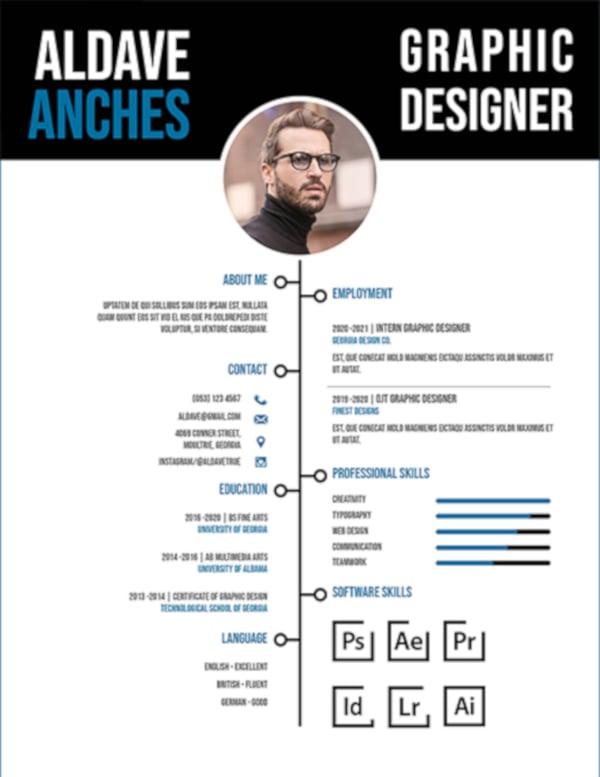

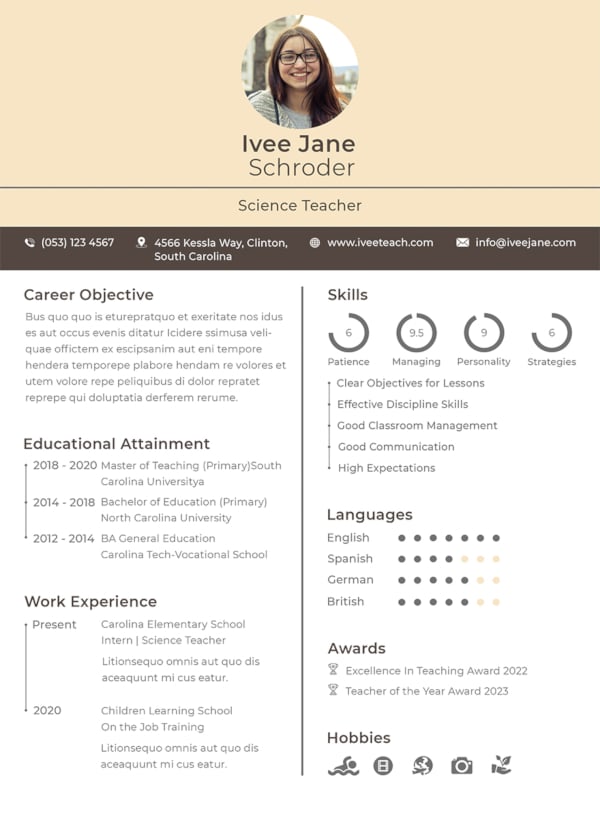

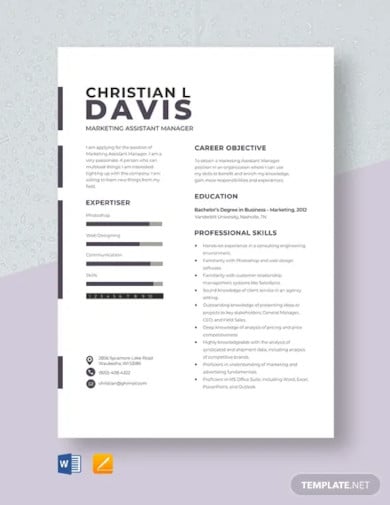

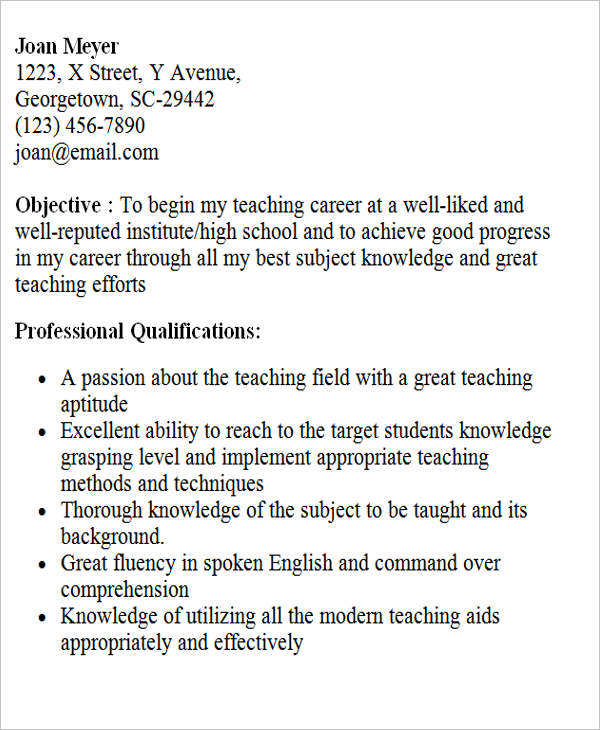

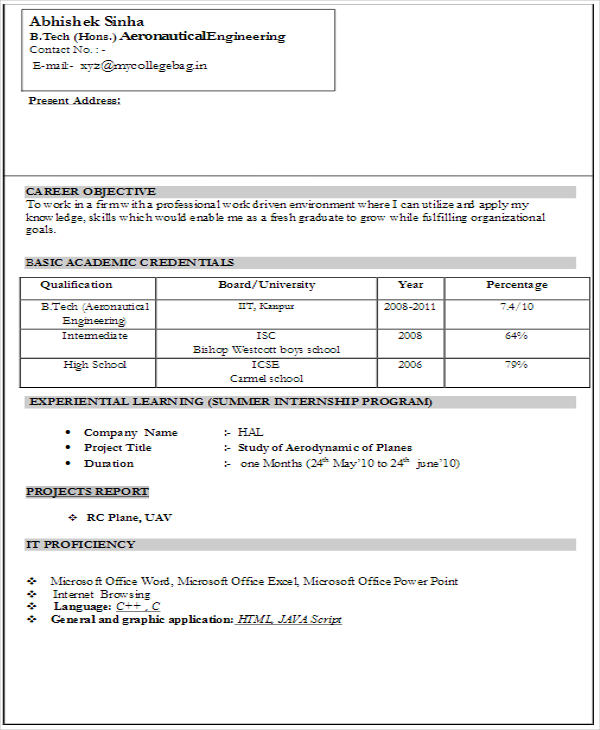

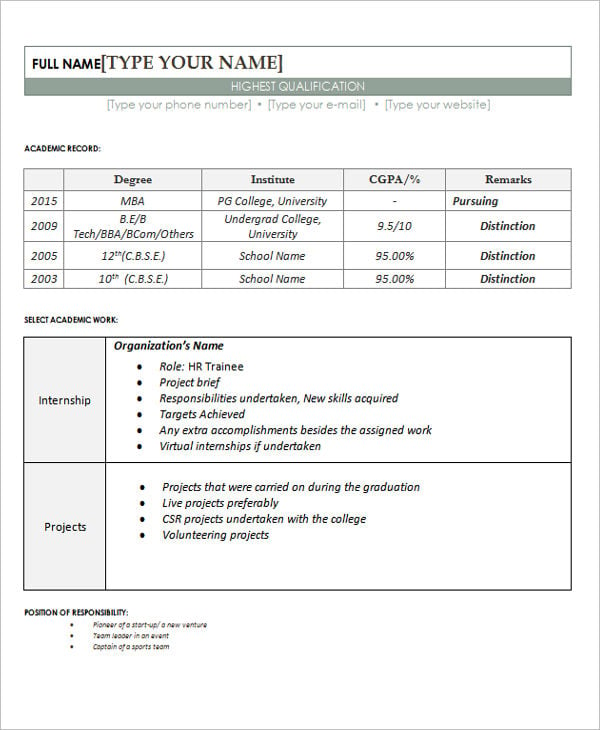

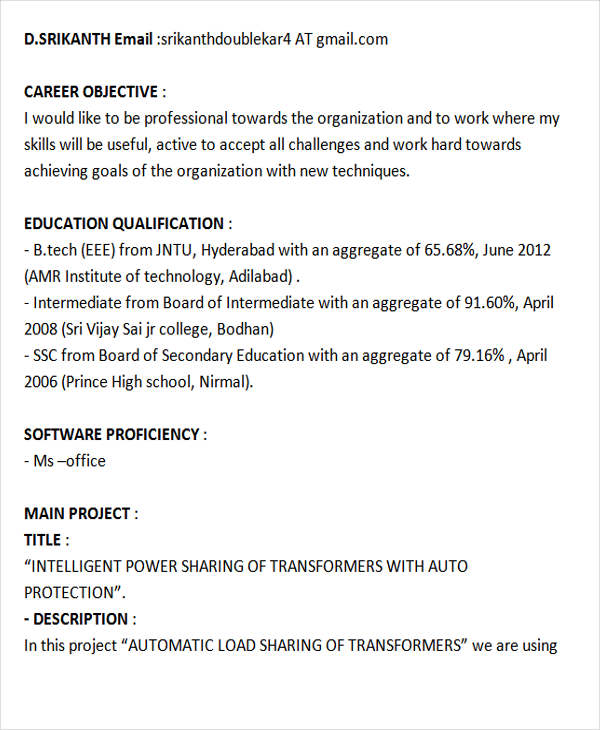

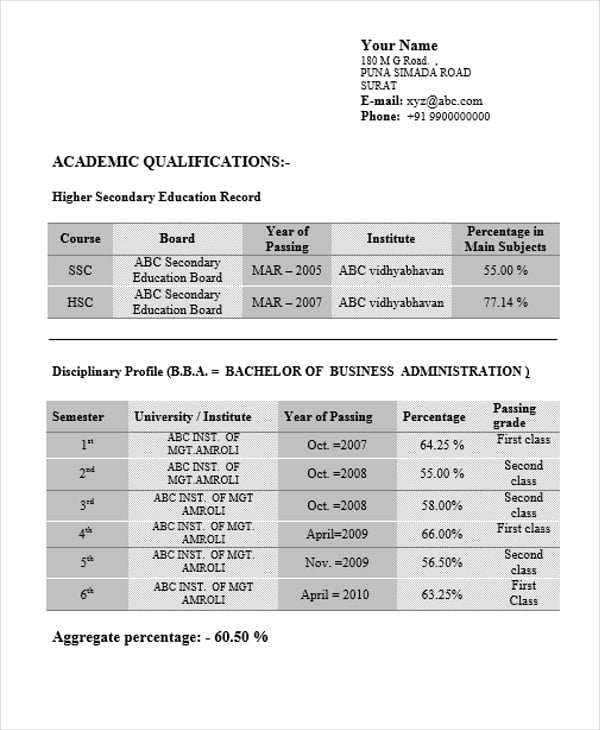

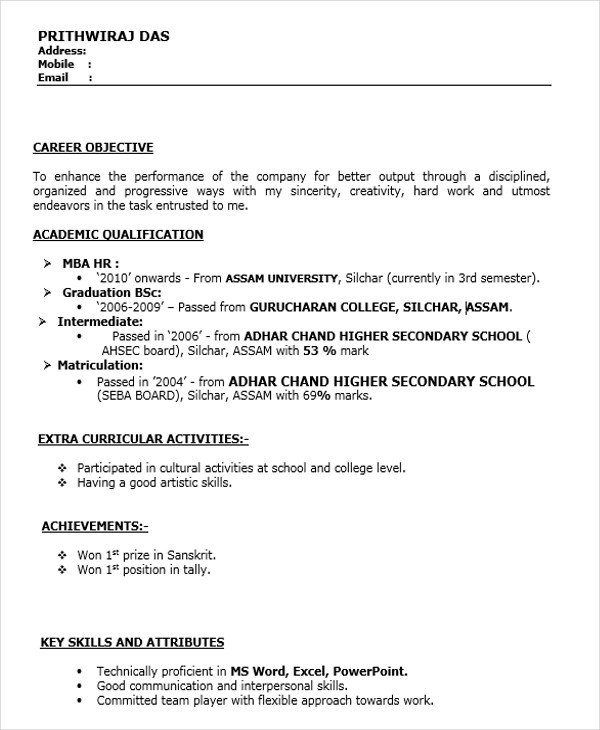

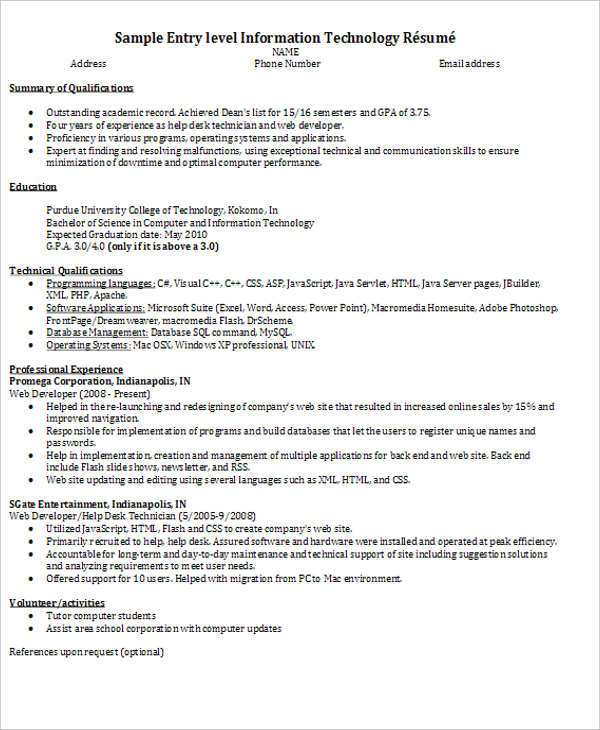

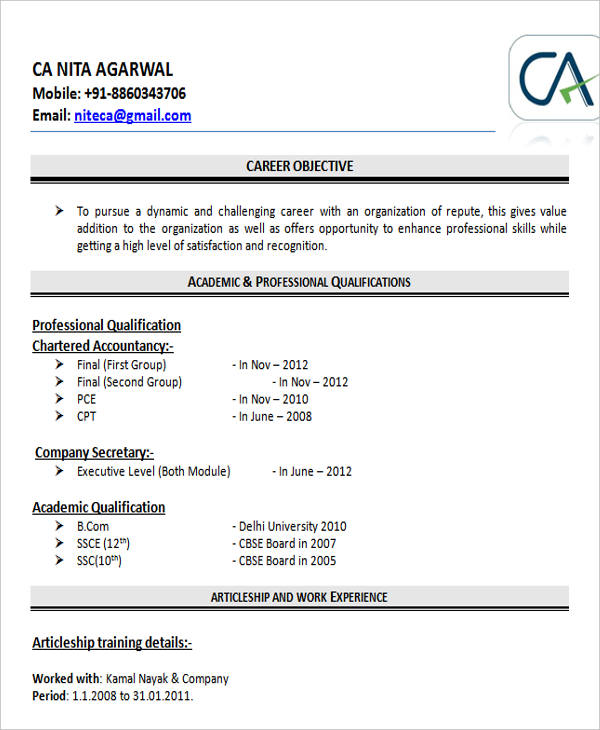

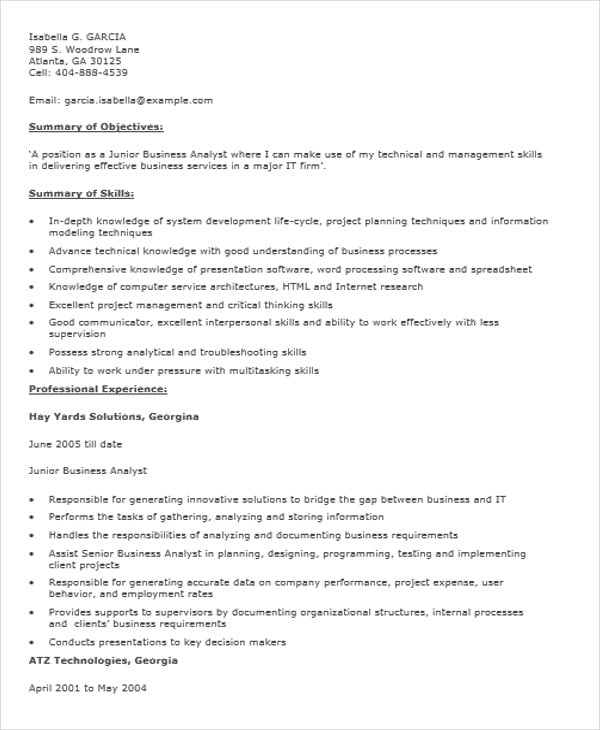

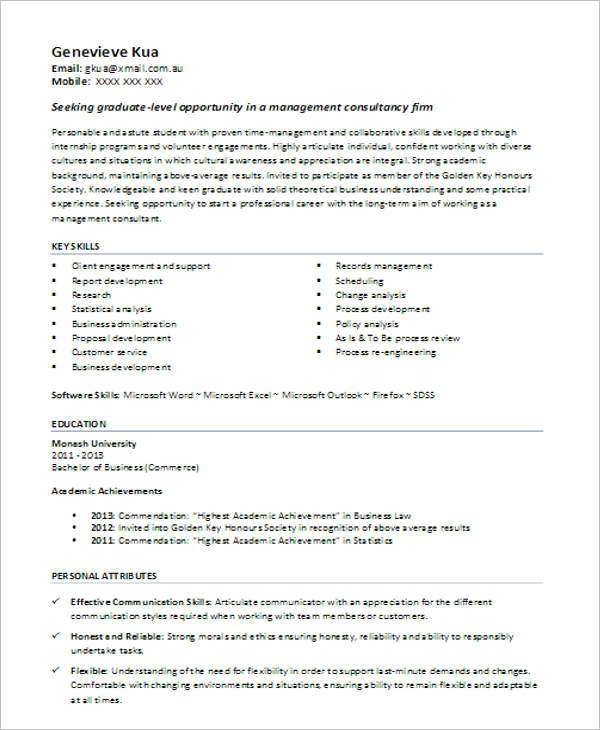

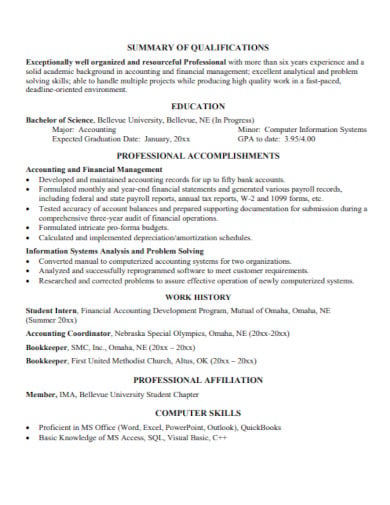

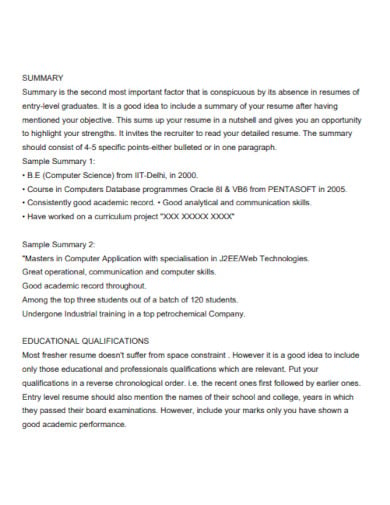

B.com fresher resume format 2, b.com fresher resume format 3.

You can write it as “ Bachelor of Commerce (B.Com)” or “ B.com Computers” or B.Com Hons .

A functional type of resume is best for B.Com freshers.

Accounting, cashier, teaching, reception, computer operating, taxation, marketing, shopkeeper, BPO, etc.

It will be around 15,000 to 30000 Rs depending on your skills, company, and the location where you want to work.

Yes, doing MBA is beneficial to the B.Com students, but do it in top colleges or IIMs. Otherwise, it is better to do it in distance mode while doing any job.

MBA finance is best for B.Com students.

One page is enough for a fresher B.Com resume. If you couldn’t able to fit everything in one page then add a second page.

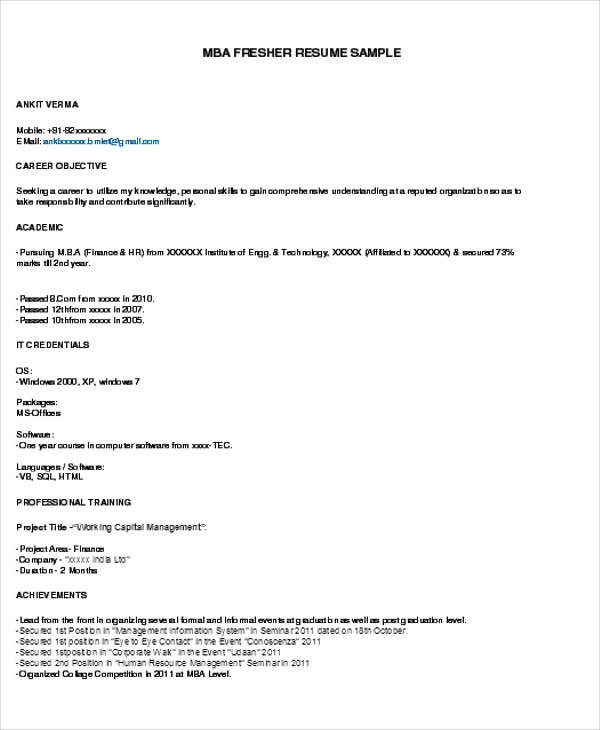

- MBA HR fresher resume formats in Word.

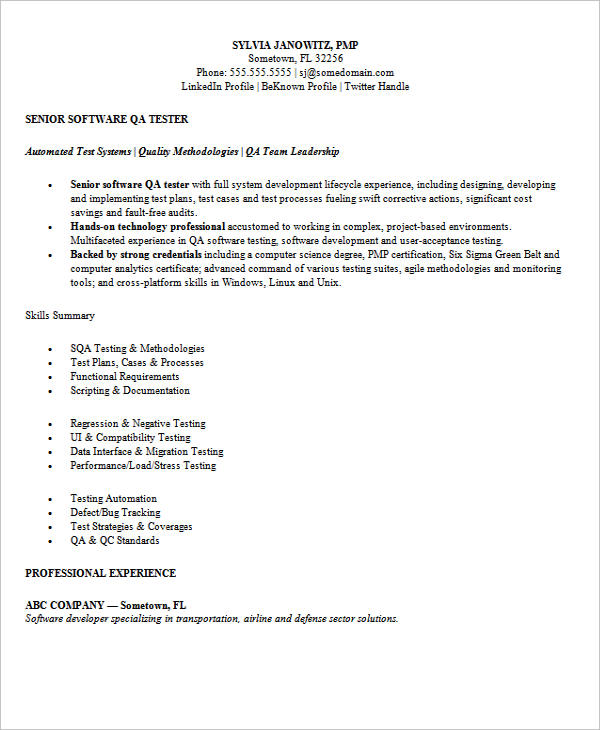

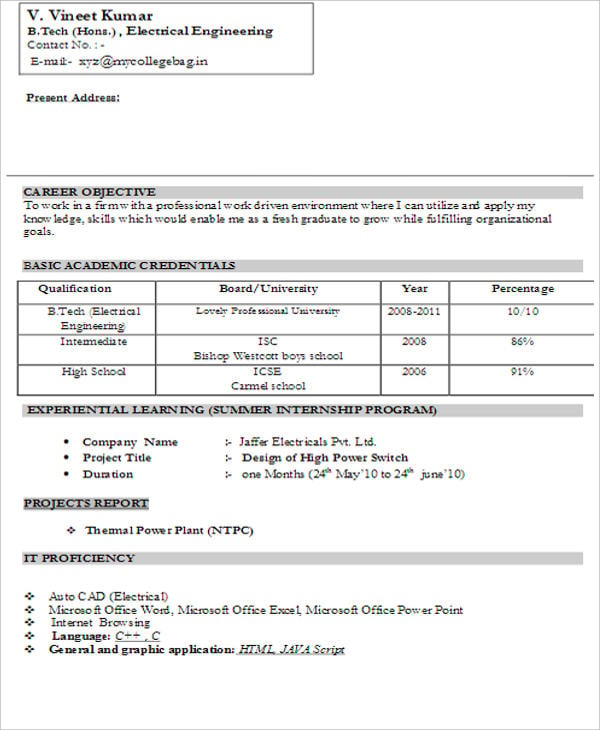

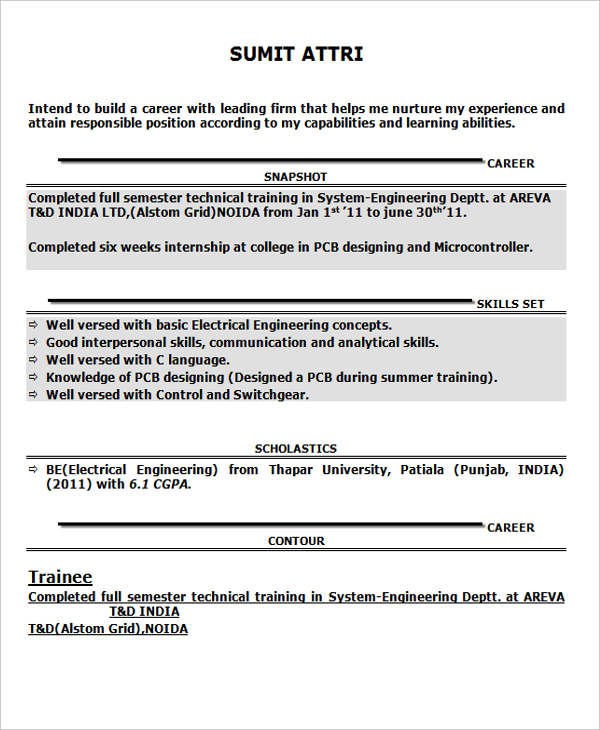

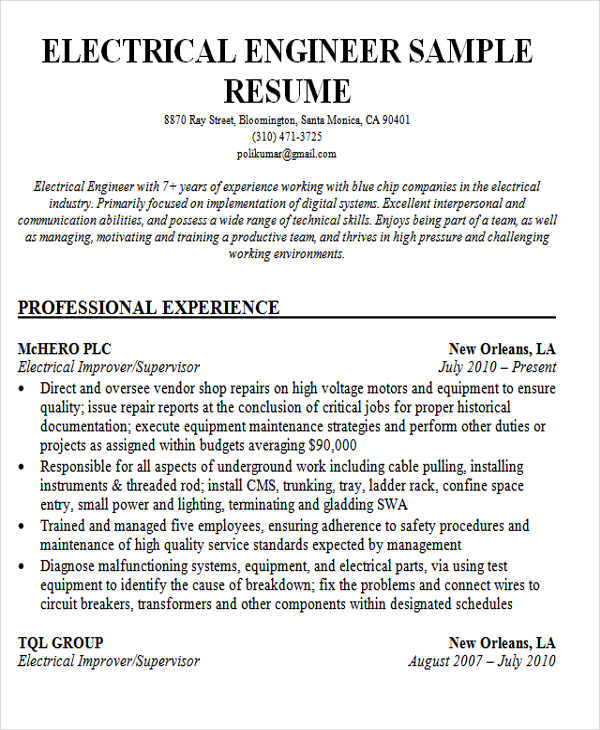

- Software engineer fresher resume formats in Word.

8 thoughts on “Sample Resumes for B.Com Freshers | Download Word Format”

Respected sir/madam I was graduated b.com (General) I hade no idea how to create resume can you kindly help me And I have no skill of anything So what to make resume better to create

1. Search for B.Com related jobs on Google. 2. Identify any top 5 skills that you can learn like Excel, Tally etc. 3. Learn basics of those skills on Youtube (or) any coaching center 4. Once you know the basics, put them in your resume, and start attending interviews.

Hi sir/madam this is Evangelin my education was b.com information systems management my passout is 2022 I don’t have any backlogs my degree percentage was 85% my 10th percentage 56% my 12 percentage is 60% this is my details

Search online resume maker than select the link fill the details and download…easy way to make modern professional resume

more resume format

Dear sir , I am an job seeker with B.com graduation i want some professional resumes as an example to create my own plz help me to figure out

Dear sir,iam and job seeker with b.com graduation i want some professional resumes as an example to create my pls help to me figure out

Check online

Leave a Comment Cancel reply

- Knowledge Base

- Free Resume Templates

- Resume Builder

- Resume Examples

- Free Resume Review

How to make a resume for a B.Com fresher?

In the current job market with ever-growing competition, having a compelling resume is indispensable for freshers looking to secure a job and it’s no exception for freshers with a Bachelor’s degree in Commerce.

But crafting a resume that adequately highlights your strengths and knowledge can get confusing because a resume is not just a summary of your educational qualifications and skills.

It is in fact your first and only chance to make a lasting impression on recruiters to get shortlisted for interviews.

According to surveys, recruiters only spend about 6 seconds reviewing a single resume to decide its suitability for the role. This means that as a B.Com fresher, you just have a few seconds to prove your potential to employers.

All the more reason to put in the extra effort while building your B.Com resume.

So, continue reading to get insightful tips that adhere to the industry’s best practices for making a B.Com resume that will land you your first job.

- What is the best B.Com resume format?

- How do I write a resume for a commerce student?

- What are some must-include skills for a B.Com fresher resume?

- How to create an impressive B.Com fresher resume education section?

B.Com Graduate Fresher Resume Format

A resume format refers to the way a resume is sectioned and organized. It also refers to the order of sections and information presented in a resume, which can determine which details are highlighted the most.

There are 3 types of resume formats that can be used by B.Com freshers while making their resumes. They are:

Reverse Chronological Format

The reverse chronological format is the most preferred and widely used format that showcases a candidate’s most recent qualifications and experiences, followed by the older ones.

A resume following this format generally includes sections like header, contact information, summary/objective, skills, professional experience , internship experience, education, and certifications.

Functional Resume Format

A functional resume format highlights a candidate’s skills over their experiences.

Instead of a section like professional or internship experience, resumes following this format include a section titled ‘summary of skills’ wherein the skills of the candidate are exemplified.

Combination Resume Format

As the name suggests, this resume format incorporates elements of both functional and reverse chronological resume formats.

This means that if you create a B.Com fresher resume following the combination resume format , you need to create sections for both summaries of skills and internship experience.

Also Read: What is the best resume format for freshers in 2023?

B.Com Fresher Resume Writing Tips

To streamline the entire process of creating a stellar B.Com fresher resume for you, here are some useful tips you can follow:

Grab the Recruiters’ Attention Right Off the Bat with an Impressive Objective Section

One of the first things that recruiters will read in your B.Com fresher resume is your objective section as it is placed at the top of a resume.

Thus, you need to make the best out of it by highlighting some of your most notable academic accomplishments, certifications, skills, and knowledge in 2 to 3 sentences.

You can also highlight any academic awards and honors that you may have received for excellent performance in academics.

Also, don’t forget to express your enthusiasm to leverage your skills and knowledge to benefit the company in a concrete, real manner.

Also Read: How to write a winning resume objective as a fresher in 2023?

Go Beyond Soft Skills

When listing skills in your B.Com fresher resume, don’t just limit them to communication, time management, analytical skills , etc.

To create a more impactful skills section, identify and list skills that show your expertise and knowledge.

Given below are some of the in-demand skills for B.Com freshers that you can list in your resume if you possess them:

| Financial analysis & reporting | Accounting |

| MS Excel | QuickBooks |

| Business communication | Taxation laws & regulations |

| Data analysis & interpretation | Budgeting |

| Project management | Market research & analysis |

| Auditing | Forecasting |

| Bookkeeping | SAP & Tally |

Tailor Your B.Com Fresher Resume for a Specific Job Listing

To significantly increase your chances of getting shortlisted for jobs, you need to curate your B.Com resume as per the requirements of a specific listing.

To do so, you must analyze the job description and identify the key requirements of the role and showcase skills & knowledge that exemplify your potential to meet them.

And if you don’t want to do this manually, you can use Hiration’s ChatGPT powered resume builder that offers a job match feature wherein you can copy-paste the job description of the role you’re targeting and have your resume assessed for skill gaps.

Format Your B.Com Fresher Resume the Correct Way

To enhance the readability of your B.Com fresher resume, you must follow the following pointers and give it a professional look:

- Create distinctly titled sections in your B.Com resume to showcase your career trajectory

- Use your full name as the header for your B.Com fresher resume in 14 to 16 points font size

- Use bullet points to describe volunteer or internship experiences you may have. You can also use bullet points in your skills and education sections

- Avoid using fonts with fancy characters as it can hamper your resume’s ATS readability

- Leave ample space between resume sections to avoid a cramped look

- To make your B.Com resume ATS friendly , use keywords across your resume and avoid using graphs, illustrations, or charts

Include Details of the Course Modules in the Education Section

To emphasize your industry knowledge, you must list key course modules that were a part of your syllabus under the education section of your B.Com fresher resume.

Apart from this, you must clearly list the name of the degree you completed, the name of the university, commencement & completion dates, location, and GPA if it is higher than 4.0.

You can also include details of your academic achievements like Dean’s list, scholarships, study abroad experience, etc. in this section to make it more impressive.

Here’s a sample of what an ideal education section looks like for recent graduates:

Also Read: What are some of the best work-from-home jobs for freshers in 2023?

- Use the reverse chronological resume format to create your B.Com fresher resume as it is recognized by most recruiters and also supports the ATS-friendliness of your resume.

- Your B.Com fresher resume objective must highlight your most notable academic accomplishments, certifications, skills, and knowledge in 2 to 3 sentences.

- To significantly increase your chances of getting shortlisted for jobs, curate your B.Com resume as per the requirements of a specific listing.

- To emphasize your industry knowledge , you must list key course modules that were a part of your syllabus under the education section of your B.Com fresher resume.

- Use bullets points , action verbs, and keywords in your B.Com resume to make it more impactful.

- Include details of your academic achievements like Dean’s list, scholarships, study abroad experience, etc. in the education section to make it more impressive.

Want to create a brilliant B.Com fresher resume within minutes? Use Hiration’s ChatGPT-powered resume builder with 24x7 chat support.

Share this blog

Subscribe to Free Resume Writing Blog by Hiration

Get the latest posts delivered right to your inbox

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Is Your Resume ATS Friendly To Get Shortlisted?

Upload your resume for a free expert review.

Resume Summaries for Fresh Graduates with Examples

A resume summary is a short description at the top of your resume that briefly describes your experience, skills and why you’re an ideal candidate for a job. Using a resume summary can help recruiters decide whether they want to give your resume more attention or not. In this article, you can review various examples of resume summaries for recent graduates with explanations for each sample.

Resume summary examples for recent graduates

Here are some examples of resume summaries for recent graduates that you can use when writing own resume:

Retail Associate

Example: ‘Aspiring Retail Associate with strong interpersonal and communication skills. Goal-oriented individual with a strong understanding of how to treat customers. Participated in skills development workshops at Boston College.’

This example begins with a statement of your career goals backed with soft skills needed for the job. As a recent graduate, it can help to focus on what you can offer to the recruiter rather than your specific experience.

Customer Service Representative

Example: ‘A former part-time shop attendant with a basic understanding of customer service looking for an opportunity in sales. Hard-working, proactive individual with strong problem-solving and communication skills and the ability to learn new concepts fast.’

When writing a resume summary as a new graduate applying to a Customer Service Representative position, focus on soft skills that are important for the job. Hiring managers in the customer service industry often focus more on a candidate’s experience and skills related to the job rather than the educational background. Start the resume summary by mentioning previous work experience relevant to customer service before describing your soft skills.

Sales Assistant

Example: ‘Recent graduate with a degree in business administration and a GPA of 3.5 looking for a position as a Sales Assistant. Reliable communication skills, both oral and written, with a basic understanding of sales and marketing. Capable of working in a fast-paced and demanding environment.’

Highlighting your achievements relevant to the job no matter how small they might be can be very useful in giving your resume an appeal to recruiters. Emphasizing GPA, academic training and responsibilities in school can give an impression of how responsible you are with fulfilling tasks. Soft skills necessary for the job are also important to include in your resume summary.

Nursing Assistant

Example: ‘Nursing student with a passion for helping people looking for a position as a Nursing Assistant. Demonstrated strong communication and leadership skills through volunteering with Red Cross International.’

This example is brief but informs the hiring manager about the individual’s background by highlighting skills and interests. It also shows that this is the right career path for the applicant because the interests and skills align well with the industry.

Gym Instructor

Example: ‘Health Science student with a major in Fitness and Nutrition. Highly motivated to work as a fitness instructor to demonstrate communication, time management and problem-solving skills. Physically fit to serve as a role model to new clients.’

If you have no experience working in the field, it is recommended that you focus on your coursework to give recruiters an idea of your educational background. You can also add important skills and characteristics that can show recruiters what you can contribute to the position and why you are an ideal candidate.

Medical Scribe

Example: ‘Recent graduate with technical knowledge in computing, data entry, communication software and databases. Interned as a clinic assistant at St. Luke’s Medical Center. Self-motivated, eager to learn, can work in a fast-paced environment and effectively communicate with other people.’

This resume summary for a Medical Scribe started by emphasizing technical skills fitting for an ideal candidate. It also indicated an internship experience which most recruiters prefer from fresh graduate applicants, and soft skills ideal to perform the tasks.

Information Technology (IT)

Example: ‘IT graduate major in computer programing with a background in Java application, HTML, CSS, Python, Tomcat, MySQL and Oracle database. Experience working in an IT company as software support as part of on-the-job training. Highly analytical, motivated and skilled at solving programming problems. Can work well both independently and in a team.’

When making a resume summary for the IT industry, you have to be specific with your skills. You need to emphasize which area you are most capable in to make sure that recruiters know that you are qualified for the job. Both technical and soft skills are important in the IT industry, so it is ideal to highlight them first in your resume.

Example: ‘Recent graduate with a degree in finance and knowledge of data management and cost and performance analysis. Skilled in identifying and resolving wash sales and share quantity discrepancies. Knowledge in virtual portfolio management, stock valuations, financial statement analysis and business management. Excellent problem-solving skills and experienced with using the latest financial software.’

A powerful resume summary understands the importance of providing specific information to readers. It should be able to cover a wide range of skills and background for the job and include enough information to highlight the strongest points of your resume to capture the attention of hiring managers.

Example: ‘Recent college graduate with an internship at Wall Street Financial Group. Seeking an entry-level accounting position to demonstrate accounting skills and knowledge. Highly competent, hardworking and detail-oriented with the capacity to go beyond what is expected to achieve higher career goals.’

This is an example of a resume summary that is brief but shares enough detail to encourage the hiring manager to read the resume more. In this example, the academic background is not mentioned. Instead, it focuses more on skills, experience and goals.

Primary Teacher

Example: ‘A recent graduate with a degree in primary education and a teaching certification, capable of teaching math to children between the ages of seven and 12 years old. Highly adept at various teaching techniques and ensures quality teaching by following education board standards, while making the learning environment fun and conducive to learning.’

This is an ideal resume summary for applicants applying to a teaching position because it highlights teaching skills and academic background. In your summary, you should mention specific credentials, such as the teaching certification, and show positive and nurturing characteristics, as well as other soft skills, to assure the recruiter that you work well with children.

Math Teacher

Example: ‘A highly organized Math Teacher with proven skills in teaching through teacher certification, academic awards and on-the-job training as a teacher’s assistant in a private school. Ability to work in a team, solve problems professionally and create a nurturing environment. Skilled at communicating complex ideas in a simple but entertaining manner. Looking for an opportunity to share my knowledge and skills in a school that offers career progression.’

This resume summary is very informative about the applicant’s background. It highlights academic achievements and skills that are ideal for a teaching position. It also sounds professional while highlighting a career-driven goal.

Example: ‘Graduate with a degree in office administration experienced in handling calls and organizing schedules. Possesses strong analytical and problem-solving skills, and takes a practical approach in handling different tasks. Looking for a position as a Secretary in a fast-paced environment.’

Recent graduates applying for secretarial jobs whether entry-level or not, should focus on highlighting their specific skills related to the role. Showing the capacity to fulfill the job is ideal to observe in resume summaries, especially that a secretarial job requires strong organization and communication skills aside from having a good credential. It is also advisable to include how an applicant deals with the day-to-day tasks of a Secretary.

Receptionist

Example: ‘Highly-skilled hospitality management graduate with various on-the-job training in a hotel, restaurant and office setting. Friendly and works well with customer concerns and has strong interpersonal and communication skills. Looking for a position as a Receptionist in the hospitality industry.’

Ideally, a resume summary for a Receptionist role highlights your educational background, experience in the industry (if available) and most importantly, the soft skills. It is highly recommended to indicate a customer-friendly and inviting personality in your resume summary.

Logistics Clerk

Example: ‘Recent graduate with strong attention to detail and organization skills looking for an entry-level job as a Logistics Clerk to build a career in the logistics industry. Can handle large amounts of information, multitask, answer calls and perform data entry jobs.’

While highlighting experience is ideal, resume summary for logistics focuses more on the skills required to function on the job. It would also help to express the kind of personality fitting for the job as well as the career goals.

Human Resources Assistant

Example: ‘Goal-oriented Human Resources recent graduate with experience as a Human Resources intern in an outsourcing company to assist in training and skill development. Highly adept in developing training programs and has excellent oral and written communication skills.’

This resume summary for an HR Assistant focuses mainly on academic background, work experience and specific skills gained from previous first-hand experience in the field. This is one way to emphasize how prepared you are for the job which can leave a good impression on recruiters.

Related: Writing a Resume Summary (With Examples)

At 1minresume, we strive to offer you the best online experience. To achieve this, we request that you disable your adblocker. By turning off your adblocker, you'll help us continue delivering quality content and ensure you can navigate our site seamlessly.

Best bcom fresher resume format for 2023 (+ free examples), 04 apr 2023.

Best BCom Fresher resume formats - freshers and experienced graduates

A BCom degree, also known as a Bachelor of Commerce degree, is an undergraduate degree program that focuses on various aspects of business, commerce, and economics. It is a popular degree program offered by many universities and educational institutions worldwide. BCom programs typically provide students with a solid foundation in business and commerce principles, practices, and theories.

The curriculum of a BCom degree program may include courses in areas such as accounting, finance, economics, marketing, management, business law, statistics, entrepreneurship, and business ethics. Students may also have the option to specialize in a particular field, such as finance, marketing, human resources, or international business, depending on the specific program and university.

The goal of a BCom degree program is to prepare students for careers in various areas of business, commerce, and related fields. Upon completion of a BCom degree, graduates may pursue employment opportunities in fields such as finance, accounting, marketing, sales, human resources, consulting, and entrepreneurship. Some graduates may also choose to pursue advanced degrees, such as a Master of Commerce (MCom) or a Master of Business Administration (MBA), to further enhance their career prospects.

Why BCom is a special degree?

Be happy and proud if you are a BCom graduate. A Bachelor of Commerce (BCom) degree is special because it offers a business-focused curriculum with subjects such as accounting, finance, marketing, and management. It provides versatility and flexibility through elective courses or specialization options. BCom programs emphasize practical skills development through real-world experiences like case studies, internships, and group projects. Graduates can pursue diverse career opportunities in various sectors and industries, and may have the opportunity to earn professional certifications. BCom programs also offer networking opportunities, helping students build valuable connections with potential employers and industry contacts. Overall, a BCom degree equips graduates with a comprehensive business education, making it special for its focus on business and commerce, versatility, practical skills development, career prospects, and networking opportunities.

Did you know - Notable personalities with a BCom degree!

Mukesh Ambani is an Indian business magnate and the Chairman of Reliance Industries Limited, one of India's largest conglomerate companies. He holds a BCom degree from the University of Mumbai, India.

Ratan Tata is a renowned Indian industrialist and philanthropist, known for his leadership of the Tata Group, one of India's oldest and largest conglomerate companies. He earned a BCom degree from Cornell University in the United States, and later completed the Advanced Management Program from Harvard Business School.

Azim Premji is an Indian business tycoon and philanthropist, known for his leadership of Wipro Limited, a global information technology services company. He holds a BCom degree from St. Joseph's College, Bangalore, India.

Kumar Birla is an Indian industrialist and the Chairman of the Aditya Birla Group, one of the largest conglomerate companies in India. He earned a BCom degree from the University of Bombay, India, and an MBA from the London Business School, UK.

Vijay Mallya is a former Indian businessman and a prominent figure in the Indian aviation and liquor industry. He holds a BCom degree from St. Xavier's College, Mumbai, India.

Indra Nooyi is a renowned businesswoman who served as the CEO of PepsiCo, one of the world's largest food and beverage companies, from 2006 to 2018. She holds a BCom degree from Madras Christian College in India and a Master's in Business Administration (MBA) from the Yale School of Management.

Natarajan Chandrasekaran, commonly known as "Chandra," is the Chairman of Tata Sons, one of India's largest conglomerate companies. He holds a BCom degree from Loyola College, Chennai, India, and is known for his leadership in the global business community

These are just a few examples of notable personalities who have earned a BCom degree and have gone on to achieve significant success in their respective fields of business and leadership. It highlights the potential of a BCom degree as a solid foundation for building successful careers in the business world.

Now, let's take a look at what makes the BCom degree so special. Here are some things that are special about a BCom degree:

A BCom degree program is specifically designed to provide students with a solid foundation in business and commerce principles, practices, and theories. The curriculum typically covers a wide range of subjects related to accounting, finance, economics, marketing, management, and other business-related areas, preparing graduates with knowledge and skills relevant to the business world.

BCom degrees are versatile and flexible, allowing students to choose from various elective courses or specialize in a specific field of business, such as finance, marketing, human resources, or international business. This flexibility allows students to tailor their education to their interests and career goals, and potentially opens up diverse career opportunities in various industries and sectors.

BCom programs often emphasize the development of practical skills that are highly applicable in the business world. Through case studies, group projects, internships, and other hands-on learning opportunities, students can gain real-world experience and develop skills such as critical thinking, problem-solving, communication, teamwork, and leadership, which are highly valued by employers.

BCom graduates can pursue a wide range of career opportunities in various sectors, including finance, accounting, marketing, sales, human resources, consulting, and entrepreneurship. The business and commerce skills gained through a BCom degree are transferable and can be applied in diverse industries and job roles, providing graduates with a versatile skill set that can lead to promising career prospects.

Many BCom programs also provide opportunities for students to earn professional certifications, such as Chartered Professional Accountant (CPA), Chartered Financial Analyst (CFA), or Certified Human Resources Professional (CHRP), depending on the specific program and university. These certifications can enhance the credentials of BCom graduates and potentially improve their employability in the job market.

BCom programs often provide networking opportunities, such as internships, industry events, guest lectures by industry professionals, and alumni networks, which can help students build valuable connections with potential employers and industry contacts, and facilitate career development.

Overall, a BCom degree provides students with a strong foundation in Business and prepares them for a successful career in the field of business management.

What makes a format best for BCom Fresher resume

A resume format for a fresh graduate with a Bachelor of Commerce (BCom) degree should highlight their education, skills, and any relevant experiences to make it stand out. Here are some tips on what makes a resume format effective for a BCom fresh graduate:

Use a clean, easy-to-read font, and maintain consistent formatting throughout the resume. Organize the resume with appropriate headings and sections, such as "Education," "Skills," "Experience," and "Achievements," to make it easy for the reader to navigate.

As a recent BCom graduate, highlight your education prominently on the resume. Include details such as the name of the university, degree earned, major, and graduation year. Mention any academic achievements or relevant coursework that showcases your expertise in areas such as accounting, finance, marketing, and management.

Highlight relevant skills that you possess, such as financial analysis, data analysis, communication, teamwork, and problem-solving. Mention any certifications or software proficiency that are relevant to the job or industry you are applying for.

If you have any relevant internships, part-time jobs, or extracurricular activities during your studies, mention them on your resume. Include details such as the company/organization name, your role, responsibilities, and achievements. This demonstrates your practical experience and application of theoretical knowledge.

Mention any notable achievements, awards, or recognitions that you have received during your academic or professional career. This could include academic honors, leadership roles, or accomplishments that highlight your skills, dedication, and achievements.

Customize your resume for each job application by highlighting skills and experiences that are relevant to the specific job or industry. This shows the employer that you have taken the effort to understand the job requirements and are a good fit for the role.

Ensure that your resume is error-free, with no spelling or grammatical mistakes. A well-proofread resume reflects attention to detail and professionalism.

Overall, the best resume format for BCom fresh graduates should be well-organized, easy to read, and highlight their technical skills, education, and relevant work experience. And, remember, a resume is your first impression with potential employers, so make sure it is concise, well-organized, and tailored to highlight your strengths, education, and relevant experiences as a BCom fresh graduate.

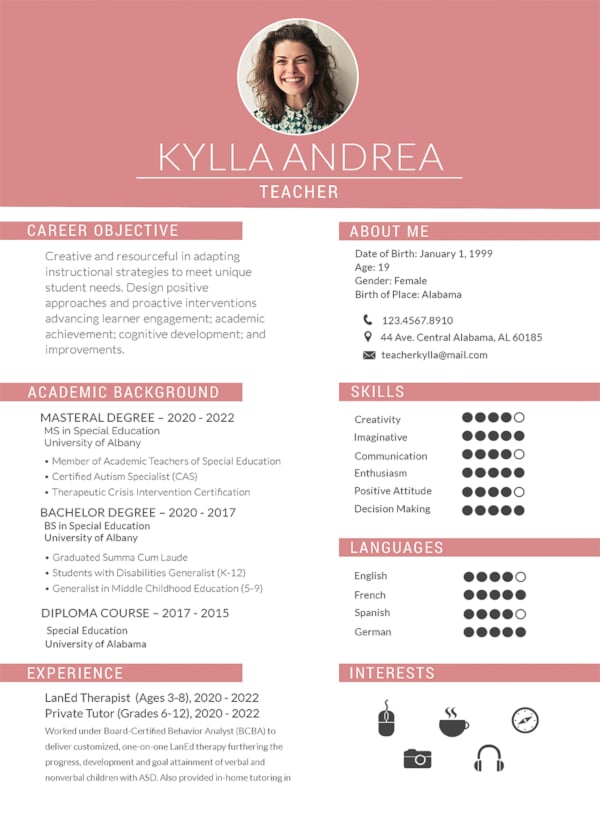

Ready to use BCom Fresher Resumes

How to use our BCom Fresher resume formats?

Once you downloaded the resume format you like, make sure to first remove the disclaimer text on the second page. All our resume formats are developed with fresh graduates in mind. Once you removed the disclaimer section on the second page, start with changing the name, address, email address, any links to portfolios, link to linkedin and your phone numbers. Make sure your email address and public profile links dont' have anything funny or crazy references; for example, don't use an email address like [email protected] or [email protected] etc.

Once you changed the contact info related sections, move on to editing the career objective statement; please keep in mind that the career objective statements we have prepared are generic in nature and should work well for any BCom Fresh graduate as such. But, we understand you may want to change so it's fine. Make sure that you don't introduce any grammatical or typograpical errors in the career statement. My best advice, just don't revise the career statement we have provided.

Then, move on to editing the college and university name. Don't include graudate % or GPA etc, unless it is very good and you can back the high % in itnerviews. Then, finally edit your student projects. We may show 2 projects, but if you have only one to show, delete the other one and adjust the height to fill up the entire page - it is okay if you cannot fill up the whole page.

Most important technical skills for BCom Fresher resume

As a Bachelor of Commerce (BCom) graduate, there are several technical skills that could be important depending on your specific field or industry. Here are three broad technical skills that could be valuable for many BCom graduates:

BCom graduates often work in finance-related roles, and therefore, possessing strong financial analysis skills can be crucial. This includes the ability to analyze financial statements, interpret financial data, assess financial ratios, and perform financial forecasting. Proficiency in using financial analysis tools, such as Microsoft Excel or specialized financial software, can also be highly beneficial.

If you're a BCom graduate who wants to showcase financial analysis skills on your resume, even if you didn't have extensive coursework in college, there are several steps you can take to develop and highlight those skills:

Take the initiative to self-study financial analysis concepts and tools. There are plenty of online resources, tutorials, and courses available that can help you learn financial analysis techniques, such as analyzing financial statements, interpreting financial ratios, and performing financial forecasting. You can also study relevant textbooks, articles, and industry publications to gain knowledge and stay updated with the latest trends.

Gain practical experience by working on real-world financial analysis projects. You can start by analyzing financial statements of publicly traded companies, examining annual reports, and conducting financial research. You can also volunteer to help local non-profit organizations or small businesses with their financial analysis needs to gain hands-on experience.

Consider obtaining relevant professional certifications that validate your financial analysis skills. Certifications such as Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or Certified Financial Planner (CFP) can enhance your resume and demonstrate your commitment to professional development.

Look for internships or entry-level jobs in finance-related roles, such as financial analyst, financial planning and analysis (FP&A), or investment analysis. These opportunities can provide practical experience and help you apply financial analysis skills in a real-world setting, which can be a valuable addition to your resume.

Identify and highlight transferable skills from your college coursework or other experiences that are relevant to financial analysis. For example, skills such as data analysis, quantitative analysis, critical thinking, and attention to detail can be applicable to financial analysis and should be emphasized on your resume.

If you have completed any financial analysis projects or achieved specific outcomes, be sure to highlight them on your resume. For example, mention any cost savings, revenue increases, or process improvements that resulted from your financial analysis work to demonstrate your impact and effectiveness.

Remember to customize your resume to highlight your financial analysis skills based on the specific job requirements or industry you are targeting. You can also mention your willingness to learn and grow in your cover letter or during interviews to demonstrate your motivation and dedication to developing financial analysis skills. Overall, proactively developing and showcasing your financial analysis skills through self-study, practical application, certifications, relevant work experience, and highlighting transferable skills can help you effectively demonstrate your competency in financial analysis, even if you didn't have extensive coursework in college.

In today's data-driven business environment, data analysis is a valuable skill across various industries. BCom graduates may need to analyze large sets of data, interpret data trends, and extract insights to inform decision-making. Skills in data visualization, statistical analysis, and data manipulation using software such as Microsoft Excel, R, or Python can be highly sought after.

If you're a BCom graduate looking to develop data analysis skills, even if you didn't have many opportunities during college, here are three effective ways to do so:

There are numerous online courses and tutorials available that cover various aspects of data analysis. You can find free or paid courses on platforms like Coursera, edX, Udemy, and LinkedIn Learning. Look for courses that focus on data analysis techniques, tools, and software, such as Microsoft Excel, R, Python, SQL, or data visualization tools like Tableau. These courses typically include practical assignments and projects that allow you to apply what you've learned and gain hands-on experience.

There are ample resources available online, such as blogs, forums, YouTube tutorials, and data analysis communities, that can help you learn and practice data analysis skills. You can start by learning the basics of data analysis, such as data visualization, statistical analysis, data cleaning, and data manipulation. You can then practice with real-world datasets, which are readily available on platforms like Kaggle, data.gov, or other open data repositories. This hands-on practice will help you improve your data analysis skills and build a portfolio of data analysis projects that you can showcase to potential employers.

Look for volunteer opportunities or freelance projects that involve data analysis. Many non-profit organizations or small businesses may need help with analyzing data for decision-making, and volunteering your skills can be a great way to gain practical experience. You can also consider offering your data analysis services as a freelancer or consultant to local businesses or individuals to build your portfolio and gain real-world experience.

It's also important to keep up with industry trends and best practices in data analysis through reading books, articles, and industry publications, attending webinars or workshops, and participating in online communities or forums related to data analysis. Networking with professionals in the field can also provide valuable insights and opportunities for skill development.

Remember to document your data analysis projects, skills, and achievements on your resume and highlight them during job interviews to showcase your competency in data analysis, even if you didn't have extensive opportunities during college. Demonstrating a proactive approach to learning and practical application of data analysis skills can be a compelling way to showcase your abilities to potential employers.

BCom graduates should be familiar with business information systems, including enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and other relevant business technologies. Understanding how to use these systems effectively and efficiently can be important for managing business processes, analyzing data, and optimizing operations.

Are you hearing Business Information Systems for the first time becaue your college courses never included them? Don't worry. There are several ways that Bcom (Bachelor of Commerce) graduates can learn about business information systems, even if their college syllabus did not even mention it. Especially some colleges possibly could have syllabus slightly outdated, but you can still learn about and demonstrate Business Information Systems in your resume. Here are some suggestions:

There are many online platforms that offer courses specifically focused on business information systems. These courses may include topics such as information technology, data analytics, database management, and business process management. Bcom graduates can enroll in these courses to gain knowledge and skills in business information systems.

Bcom graduates can engage in self-study by accessing online resources such as e-books, tutorials, articles, and videos related to business information systems. There are numerous websites and online forums that provide free or low-cost educational content on business information systems that can be used for self-study.

There are several professional certifications related to business information systems, such as Certified Information Systems Auditor (CISA), Certified Information Systems Security Professional (CISSP), and Oracle Certified Associate (OCA) in various database management systems. Bcom graduates can pursue these certifications to gain expertise in specific areas of business information systems.

Bcom graduates can attend workshops and seminars conducted by industry experts or professional organizations that focus on business information systems. These events often provide practical insights and real-world examples related to business information systems, which can be valuable for learning.

Bcom graduates can network with professionals who have expertise in business information systems and seek their guidance and mentorship. Networking events, alumni associations, and online professional communities can be helpful in connecting with experts who can provide insights and advice on learning business information systems.

Bcom graduates can take up practical projects related to business information systems to gain hands-on experience. They can work on personal projects, internships, or volunteer opportunities that involve using business information systems in real-world scenarios. This practical experience can complement theoretical knowledge and enhance their understanding of business information systems.

It's important to note that self-directed learning may require self-motivation and discipline. Bcom graduates should be proactive in seeking out resources and opportunities to learn about business information systems and be persistent in their efforts to acquire the necessary knowledge and skills.

In general, the specific technical skills needed for a BCom graduate can vary greatly depending on the field of specialization, such as accounting, finance, marketing, or management. It's recommended to research and understand the specific technical skills required in your chosen field or industry to further enhance your career prospects. Additionally, soft skills such as communication, teamwork, problem-solving, and adaptability are also crucial for professional success in any field. any function and any business; so always be on the look-out to spot these opportunities to demonstrate during your time in college and in your community.

Most important soft skills for BCom Fresher resume

As a Bcom fresher, your resume should highlight not only your technical skills, but also your soft skills that demonstrate your ability to work effectively in a professional environment. Here are three important soft skills that you can showcase on your resume:

Communication Skills: Strong communication skills are essential in any business setting. As a Bcom graduate, you can highlight your proficiency in verbal and written communication, including your ability to articulate ideas clearly and concisely, listen attentively, and effectively communicate with colleagues, clients, and stakeholders. You can also mention any relevant experiences where you have demonstrated excellent communication skills, such as presentations, team projects, or customer service roles.

"Strong verbal and written communication skills demonstrated through effective communication with team members and clients, as well as delivering presentations during academic projects."

As a Bcom fresher, you can highlight various communication skills on your resume that are relevant to the business environment. Here are some examples:

Highlight your ability to write effectively and professionally, which includes skills such as composing emails, memos, reports, or other business documents. You can mention any academic assignments or projects that required strong written communication skills, such as research papers or business plans.

"Demonstrated strong written communication skills through academic assignments involving research papers, business reports, and presentations."

Highlight your ability to articulate ideas clearly and confidently in verbal interactions. This can include skills such as presenting information, leading discussions, participating in group meetings, or delivering presentations. Mention any relevant experiences where you have effectively communicated verbally, such as class presentations or extracurricular activities.

"Proven ability to communicate effectively in verbal interactions, including delivering presentations and actively participating in group discussions and team meetings."

Highlight your ability to actively listen and understand others' perspectives, which is crucial in a professional setting. This includes skills such as paying attention to details, asking clarifying questions, and responding appropriately. Mention any experiences where you have demonstrated active listening skills, such as team projects or customer service roles.

"Proven track record of active listening skills, demonstrated through attentively listening to team members and customers, and responding effectively to their needs and concerns."

Highlight your ability to build and maintain positive relationships with others, which includes skills such as empathy, conflict resolution, and building rapport. You can mention any experiences where you have successfully worked with diverse individuals, such as team projects or extracurricular activities.

"Strong interpersonal skills demonstrated through successful collaboration with team members from diverse backgrounds, resolving conflicts professionally, and building positive relationships with clients and stakeholders."

Highlight your ability to communicate professionally and adhere to appropriate business etiquette. This includes skills such as using formal language, maintaining a respectful tone, and adhering to professional norms in written and verbal communications. Mention any experiences where you have demonstrated professional etiquette, such as internships or part-time jobs.

"Exhibited professional etiquette in all communications, including using formal language, maintaining a respectful tone, and adhering to business communication norms in various professional settings."

Businesses thrive on collaboration and teamwork. Employers value candidates who can work effectively in a team environment, contribute ideas, and collaborate with others to achieve common goals. Highlight your ability to work well in a team, your willingness to take on responsibilities, and your ability to cooperate with diverse team members to achieve shared objectives. Provide specific examples from your academic or extracurricular experiences where you have successfully worked in a team.

"Proven track record of working collaboratively in teams during group projects and extracurricular activities, demonstrating a cooperative attitude, and contributing to the team's success."

In today's dynamic business environment, adaptability and flexibility are highly valued skills. Employers look for candidates who can adapt to changing circumstances, handle ambiguity, and adjust to new situations with a positive attitude. Highlight your ability to adapt to different work environments, learn new skills quickly, and handle unexpected challenges. Provide examples where you have demonstrated adaptability and flexibility, such as adapting to changes in project requirements or adjusting to new work processes.

"Proven ability to adapt to changing environments, demonstrated through successfully handling changes in project scope and timelines, and quickly learning new software and tools."

Remember, when showcasing soft skills on your resume, it's important to provide specific examples to support your claims. You can use your academic projects, internships, volunteer work, or extracurricular activities as evidence of your soft skills. Also, be prepared to discuss your soft skills in more detail during interviews, as employers may ask for examples or further elaboration on how you have demonstrated these skills in real-world situations.

Overall, showcasing these soft skills on your BCom fresher resume can make you stand out to potential employers. Employers are not only looking for technical expertise but also for candidates who possess good communication skills, problem-solving abilities, and time management skills. These skills demonstrate your ability to work effectively with others, solve complex problems, and deliver results in a timely manner.

10 Career Objective Statements for BCom fresher resumes - for various industries

If you don't like some of the career statements we have written on the BCom resume formats you download, you can use any of these career objective statements we have assembled for you. Just make sure to pick the one for your industry. If in doubt, just go with what you already have on the template you downloaded.

These objective statements highlight both the soft and technical skills that the fresh BCom graduate possesses, and their willingness to work hard and solve problems fast. They demonstrate the candidate's eagerness to apply their BCom skills in a challenging role and their commitment to learning new business practices and management techniques to both enhance their career growth and contribute to the organization's growth.

BCom Fresher Resume Career Objective Statement for Accounting jobs

Seeking a career as an entry-level accountant where I can utilize my strong analytical skills, attention to detail, and knowledge of financial principles to contribute to the company's financial success.

Seeking a challenging role as an Accountant where I can apply my strong foundation in accounting principles, attention to detail, and analytical skills to contribute to the financial success of the organization.

To obtain a position as an Accountant in a reputable organization, leveraging my solid understanding of financial management, proficiency in accounting software, and ability to handle complex financial transactions.

A motivated and detail-oriented BCom graduate with a passion for numbers and a strong understanding of accounting concepts, seeking an entry-level role in Accounting to further enhance my skills and contribute to the financial integrity of the organization.

Seeking an entry-level role in Accounting, where I can utilize my strong analytical skills, proficiency in MS Excel, and ability to work with numbers to ensure accurate financial reporting and support the organization's financial goals.

BCom Fresher Resume Career Objective Statement for Banking jobs

Aspiring to work in a reputed bank as a banking professional, leveraging my sound knowledge of banking operations, customer service skills, and ability to work in a fast-paced environment.

Seeking a challenging role in the banking sector to utilize my strong analytical skills, understanding of financial products, and customer service orientation to contribute to the growth and success of the organization.

A highly motivated BCom graduate with a keen interest in the banking industry, aiming to secure an entry-level position in Banking where I can leverage my knowledge of financial management, banking regulations, and interpersonal skills to provide exceptional service to customers and achieve organizational goals.

To obtain a position in the banking sector that allows me to apply my solid foundation in accounting, financial analysis, and risk management to contribute to the bank's profitability while developing my career in a dynamic and challenging environment.

Seeking an entry-level role in Banking where I can utilize my excellent problem-solving skills, ability to work with financial data, and commitment to providing exceptional customer service to support the bank's operations and drive customer satisfaction.

BCom Fresher Resume Career Objective Statement for Human Resources (HR) jobs

Passionate about pursuing a career in human resources, aiming to apply my interpersonal skills, ability to handle confidential information, and understanding of HR policies and procedures in a dynamic HR role.

Seeking an entry-level role in Human Resources, where I can utilize my strong communication skills, ability to work with people, and knowledge of HR policies and practices to contribute to the development and success of the organization's human capital.

A highly motivated BCom graduate with a keen interest in Human Resources, aiming to secure a position in HR where I can apply my understanding of employee relations, talent acquisition, and HR administration to support the organization's HR initiatives and foster a positive work environment.

To obtain a challenging role in Human Resources that allows me to utilize my solid foundation in organizational behavior, labor laws, and employee engagement to contribute to the HR team's effectiveness and help the organization attract, develop, and retain top talent.

Seeking an entry-level position in Human Resources, where I can leverage my strong interpersonal skills, attention to detail, and ability to handle sensitive information to support HR processes such as recruitment, onboarding, and performance management, and ensure compliance with HR policies and regulations.

BCom Fresher Resume Career Objective Statement for Sales & Marketing jobs

Looking to start my career in sales and marketing, where I can apply my persuasive communication skills, market research abilities, and strong customer relationship management skills to achieve sales targets and drive business growth.

Seeking an entry-level position in Sales and Marketing, where I can apply my strong communication skills, customer orientation, and understanding of marketing principles to contribute to the organization's revenue growth and market expansion.

A highly motivated BCom graduate with a keen interest in sales and marketing, aiming to secure a role in the field where I can leverage my ability to build relationships, conduct market research, and create effective marketing strategies to achieve sales targets and promote the organization's products or services.

To obtain a challenging role in Sales and Marketing that allows me to apply my solid foundation in market analysis, branding, and promotional strategies to drive sales, build customer relationships, and contribute to the organization's market positioning and revenue goals.

Seeking an entry-level position in Sales and Marketing, where I can utilize my excellent interpersonal skills, creativity, and passion for sales to develop and implement sales plans, build a customer base, and achieve sales targets in a dynamic and competitive business environment.

BCom Fresher Resume Career Objective Statement for Supply Chain Management (SCM) jobs

Seeking an entry-level position in supply chain management, where I can utilize my analytical skills, knowledge of logistics, and attention to detail to optimize supply chain processes and enhance operational efficiency.

Seeking an entry-level position in Supply Chain Management, where I can apply my knowledge of logistics, inventory management, and procurement processes to optimize supply chain operations and contribute to the organization's overall efficiency and profitability.

A highly motivated BCom graduate with a keen interest in supply chain management, aiming to secure a role in the field where I can leverage my understanding of supply chain concepts, data analysis, and process improvement to drive operational excellence and achieve supply chain goals.

To obtain a challenging role in Supply Chain Management that allows me to apply my solid foundation in supply chain planning, transportation management, and demand forecasting to ensure timely delivery of goods, minimize costs, and enhance customer satisfaction.

Seeking an entry-level position in Supply Chain Management, where I can utilize my excellent analytical skills, attention to detail, and ability to work in a team to optimize supply chain processes, identify areas for improvement, and contribute to the organization's supply chain strategies and objectives.

BCom Fresher Resume Career Objective Statement for Finance jobs

Aspiring to work as a financial analyst, leveraging my strong analytical skills, proficiency in financial modeling and data analysis, and knowledge of financial statements to provide valuable insights for strategic decision-making.

Seeking an entry-level position as a Finance Analyst, where I can utilize my strong analytical skills, financial acumen, and proficiency in financial modeling and data analysis to contribute to the organization's financial planning, budgeting, and decision-making processes.

A highly motivated BCom graduate with a keen interest in finance and analysis, aiming to secure a role in the field where I can leverage my understanding of financial statements, financial ratios, and financial forecasting to provide valuable insights and recommendations for improving the organization's financial performance.

To obtain a challenging role as a Finance Analyst that allows me to apply my solid foundation in financial analysis, investment valuation, and risk management to assess financial data, identify trends, and provide accurate financial reporting and analysis to support strategic financial decision-making.

Seeking an entry-level position as a Finance Analyst, where I can utilize my excellent quantitative skills, attention to detail, and ability to work with financial data to analyze financial performance, conduct financial research, and assist in financial planning and budgeting activities.

BCom Fresher Resume Career Objective Statement for Taxation jobs

Passionate about pursuing a career in taxation, aiming to apply my understanding of tax laws, attention to detail, and ability to work with numbers to ensure compliance and optimize tax strategies for clients or organizations.

Seeking an entry-level position in Taxation, where I can utilize my knowledge of tax laws, regulations, and compliance to provide accurate and timely tax planning and compliance services to clients, and contribute to the organization's tax management and financial objectives.

A highly motivated BCom graduate with a keen interest in taxation, aiming to secure a role in the field where I can leverage my understanding of direct and indirect taxes, tax planning, and tax optimization strategies to ensure compliance with tax laws and regulations and minimize tax liabilities for the organization.

To obtain a challenging role in Taxation that allows me to apply my solid foundation in tax accounting, tax research, and tax reporting to prepare and file tax returns, assist in tax audits, and provide effective tax advice and solutions to clients and the organization.

Seeking an entry-level position in Taxation, where I can utilize my excellent analytical skills, attention to detail, and ability to work with complex tax documents and data to ensure accurate and compliant tax reporting, and assist in tax planning and strategy development.

BCom Fresher Resume Career Objective Statement for E-commerce jobs

Looking to establish a career in the e-commerce industry, utilizing my knowledge of online marketplaces, digital marketing skills, and understanding of consumer behavior to drive online sales and enhance customer experience.

Seeking an entry-level position in Ecommerce, where I can utilize my understanding of online marketplaces, digital marketing, and customer relationship management to contribute to the organization's online sales and revenue growth, and deliver exceptional customer experiences in the ecommerce space.

A highly motivated BCom graduate with a keen interest in ecommerce, aiming to secure a role in the field where I can leverage my knowledge of online sales channels, product listings, and order fulfillment to optimize online sales performance, enhance customer engagement, and drive ecommerce success for the organization.

To obtain a challenging role in Ecommerce that allows me to apply my solid foundation in online merchandising, website analytics, and ecommerce platforms to drive website traffic, optimize online conversion rates, and improve the overall online shopping experience for customers and achieve business objectives.

Seeking an entry-level position in Ecommerce, where I can utilize my excellent problem-solving skills, data-driven mindset, and ability to work with ecommerce tools and technologies to support online sales operations, analyze ecommerce performance data, and implement data-based strategies to boost online sales and customer retention.

BCom Fresher Resume Career Objective Statement for Auditing jobs

Seeking an entry-level auditing position where I can apply my keen eye for detail, understanding of auditing principles and practices, and ability to analyze financial data to ensure accuracy and integrity of financial statements.

Seeking an entry-level position in Auditing, where I can utilize my knowledge of accounting principles, auditing standards, and internal controls to provide accurate and reliable audit services, identify and mitigate risks, and contribute to the organization's financial reporting integrity.

A highly motivated BCom graduate with a keen interest in auditing, aiming to secure a role in the field where I can leverage my understanding of audit procedures, techniques, and best practices to conduct comprehensive financial and operational audits, assess compliance with regulations, and recommend process improvements to enhance organizational performance.

To obtain a challenging role in Auditing that allows me to apply my solid foundation in financial statement analysis, risk assessment, and audit documentation to perform audit procedures, evaluate internal controls, and prepare audit reports that provide valuable insights and recommendations to clients and the organization.

Seeking an entry-level position in Auditing, where I can utilize my excellent analytical skills, attention to detail, and ability to work with financial data and audit tools to execute audit engagements, verify financial information, and assist in the development of audit plans and strategies.

BCom Fresher Resume Career Objective Statement for Financial Services jobs

Aspiring to work in the financial services industry, leveraging my strong analytical skills, understanding of financial products, and customer service orientation to provide comprehensive financial solutions to clients and contribute to their financial well-being.

Seeking an entry-level position in Financial Services, where I can utilize my strong foundation in financial analysis, risk management, and investment principles to provide sound financial advice, assist clients in achieving their financial goals, and contribute to the organization's success in delivering comprehensive financial services.

A highly motivated BCom graduate with a keen interest in financial services, aiming to secure a role in the field where I can leverage my understanding of financial products, markets, and regulations to support clients in making informed financial decisions, managing their investments, and achieving financial security.

To obtain a challenging role in Financial Services that allows me to apply my analytical skills, communication abilities, and customer service orientation to provide excellent client service, promote financial products and services, and help clients navigate complex financial landscapes to achieve their financial objectives.

Seeking an entry-level position in Financial Services, where I can utilize my interpersonal skills, problem-solving abilities, and financial knowledge to establish and maintain positive client relationships, deliver financial solutions that meet clients' needs, and contribute to the organization's growth and profitability in the financial services industry.

These sample projects showcase the technical skills and expertise of the BCom student and demonstrate their ability to apply their knowledge to real-world scenarios. Including these projects on their resume with references to results can help the student stand out to potential employers and demonstrate their value as a candidate.

Market Research Project: Conducted market research to identify customer preferences, analyzed data, and presented findings to the team, resulting in improved marketing strategies and increased sales by 10%

Analyzed financial statements of a company to assess its financial health, identified areas for improvement, and provided recommendations for cost reduction, resulting in savings of INR 50,000 per quarter.

Developed a comprehensive business plan for a start-up, including market analysis, financial projections, and marketing strategies, resulting in securing a INR 1 Crore investment from an angel investor.

Implemented an efficient inventory management system for a retail store, resulting in a reduction in stockouts by 20% and an increase in inventory turnover by 15%.

Created a budgeting plan for a non-profit organization, analyzed expenses, and recommended cost-saving measures, resulting in a 10% reduction in overall expenses and improved financial sustainability.

Developed and executed a social media marketing campaign for a local business, resulting in a 30% increase in online engagement, and a 15% increase in website traffic, leading to improved brand awareness and customer engagement.

Identified bottlenecks in a company's procurement process, analyzed data, and recommended process improvements, resulting in a 20% reduction in procurement time and improved operational efficiency.

Implemented a CRM system for a sales team, trained team members, and analyzed data to optimize customer interactions, resulting in a 25% increase in customer retention and improved customer satisfaction scores.

Conducted cost analysis for a manufacturing company, identified cost-saving opportunities, and recommended changes to production processes, resulting in a 10% reduction in production costs and improved profitability.

Designed and conducted financial literacy workshops for underprivileged communities, educating them on budgeting, savings, and investment strategies, resulting in improved financial literacy and empowerment.

When including student project ideas on your resume, make sure to highlight the relevant skills, methodologies used, and the outcomes or results achieved. This will showcase your abilities and demonstrate your practical application of knowledge in real-world scenarios, making your resume more impactful.

How to show hobbies on a BCom fresher resume?

Choosing which hobbies to include on a BCom fresher resume can be strategic and depends on several factors. Before I give you some some tips to help you pick the most relevant hobbies to showcase on your resume, I want to make it very clear what the benefits of including your hobbies in the resume are.

Hobbies provide a glimpse into your personality, interests, and passions, which can help you stand out from other candidates and add a personal touch to your resume. It can create a connection with potential employers and make you more memorable.

Some hobbies can showcase skills that are transferable and relevant to the job you are applying for. For example, if you mention hobbies such as leadership in a club or sports, volunteer work, or creative pursuits, it can demonstrate skills such as teamwork, communication, leadership, creativity, and problem-solving.

Including hobbies that align with the company culture or industry can show that you are a good fit for the organization. For example, if you are applying to a company that values work-life balance and you mention hobbies like yoga, hiking, or mindfulness, it can indicate your alignment with the company values.

Hobbies can serve as conversation starters during interviews, networking events, or informal interactions with potential employers or colleagues. They can help you build rapport, showcase your personality, and create common ground for discussion.

Unique or interesting hobbies can make your resume stand out from others and capture the attention of potential employers. They can be a point of differentiation and make you more memorable in a competitive job market.

However, it's important to exercise caution when including hobbies on a resume. Not all hobbies are relevant or appropriate to mention, and the space on your resume should primarily focus on your qualifications, experiences, and achievements related to the job you are applying for. Always ensure that your hobbies are relevant, truthful, and reflect positively on your overall professional image.

Suggestions on which hobbies to pick.

Select hobbies that are relevant to the job you are applying for or highlight skills that are transferable to the workplace. For example, if you are applying for a job in the IT industry, hobbies such as coding, web design, or technology-related interests can demonstrate your passion and expertise in the field.

Even if your hobbies are not directly related to the job, they can still demonstrate transferable skills such as teamwork, leadership, or communication. For example, if you enjoy playing team sports, this can demonstrate your ability to work effectively in a team environment and collaborate with others.

It is important to keep your hobbies section brief and relevant. Only include 1-2 hobbies that showcase your skills and interests. Remember, the focus of your resume should be on your academic achievements and technical skills.

Only include hobbies that you are genuinely interested in and have pursued in the past. Avoid including hobbies that you think will impress the employer but that you have no real interest or experience in.

If you have achieved any notable accomplishments related to your hobbies, such as winning a competition or volunteering for a charity, be sure to include them. This can demonstrate your dedication, commitment, and skills outside of academics and work experience.

By following these tips, fresh BCom graduates can effectively showcase their hobbies on their resume and demonstrate their unique skills, interests, and personality to potential employers.

Hobbies for BCom Fresher Resume

Finally, if you needed some help with the list of hobbies, here is the list of 30 almost anyone can include - but, please pick up to 5 that you can show some genuine interest if the topic eveer comes up in interviews:

- Photography

- Playing a musical instrument

- Sports (such as basketball, football, tennis, etc. and cricket, of course)

- Volunteering

- Painting, Sketching or drawing

- Writing (e.g., blogging, creative writing)

- Hiking or outdoor activities

- Yoga or fitness

- Playing video games

- Watching movies or TV shows

- Collecting (e.g., stamps, coins, antiques)

- Crafting (e.g., knitting, sewing, woodworking)

- Meditation or mindfulness

- Learning a new language

- Pets or animal care

- Astronomy or stargazing

- Home improvement or DIY projects

- Playing chess or other strategy games

- Model building

- Car or motorcycle enthusiast

- Geocaching or treasure hunting

- Horseback riding

- Cooking or baking

Like we said in the other posts, you would have noticed that making youtube videos and shooting videos for instagram and snapchat are not hobbies, even if you have 1 million followers - unless the content you created and the social media following you created can demonstrate skills that are relevant to the job you are appling to.

Why BCom Fresh graduates dont get interview calls

There could be several reasons why some BCom fresh graduates struggle to receive interview calls despite having a good resume. Some potential reasons include:

While having a good resume is important, many employers also value practical experience. BCom graduates who lack relevant internships, part-time jobs, or other relevant work experience may find it challenging to secure interview calls. Employers often seek candidates who have demonstrated their skills and abilities in real-world situations.

Networking plays a crucial role in job search success, especially for fresh graduates. If BCom graduates do not actively engage in networking activities, such as attending career fairs, industry events, or leveraging personal and professional contacts, it may be harder for them to receive interview calls. Networking can help create connections, learn about job opportunities, and receive referrals, which can increase the likelihood of being called for interviews. Nothing stops you from printing your business card and distribute via newspaper distributors. Just write on the back of the business card, you are looking for a job. With a spending of 500 Rs you can network with 1000 people, easily.

The job market can be highly competitive, especially for fresh graduates. BCom graduates may face tough competition from other candidates who have similar qualifications or experiences, making it challenging to stand out and receive interview calls.

Sending out generic resumes and cover letters that are not tailored to specific job openings can result in lower response rates. Employers appreciate candidates who take the time to customize their applications to match the job requirements and demonstrate their genuine interest in the role. BCom graduates who do not tailor their applications to highlight their relevant skills, qualifications, and experiences may struggle to receive interview calls

Even with a good resume, if BCom graduates struggle during interviews, they may not progress to the next stage. Interview skills, such as effective communication, confidence, and articulation of skills and experiences, are crucial in securing job offers. Lack of interview preparation or practice can hinder the ability to perform well during interviews, leading to fewer interview calls.

BCom graduates may not be fully aware of the job market dynamics, including industry trends, job search strategies, and employer expectations. This lack of knowledge may impact their ability to effectively target job opportunities and receive interview calls.

You can do it

There are thousands of jobs that hiring managers and recruiters across companies that span the entire spectrum of the size of the companies trying to fill every single day. There are more jobs than there are qualified candidates. If you are frustrated about not finding a job, don't be. Just add one technical skill that your dream job needs and do cold calling. You will be amazed at how quickly you can find your first job.

It's important for BCom graduates to not only focus on creating a strong resume but also actively work on gaining relevant experience, networking, tailoring their applications, developing their interview skills, and staying updated with the job market. Seeking guidance from career services, mentors, or industry professionals can also be helpful in improving job search outcome

Now that you've read it

If you have found this article useful for you, you can spread some love and share the link to this article with your fellow BCom graduates looking for their first job.

Nanda Ponnambalam

Best resume writing resources, format for bio data, 05 feb 2024, top 5 fresher interview questions and answers, 28 dec 2023, fresher interview questions and answers, 14 aug 2023, how to list certifications on resume - with examples, 11 aug 2023, teamwork interview questions and answers - with examples, 29 jul 2023, 20 skills for ca resumes - with examples, 27 jul 2023, 60 action verbs in resumes - with examples, 25 jul 2023, how to be confident in interviews, 24 jul 2023, how to write a resume if you have no work experience, 15 jul 2023, most important skills to put on your resume, 26 jun 2023, resume format for freshers, 21 jun 2023, creating resume for freshers, 16 jun 2023, resume formatting demystified, 10 jun 2023, mba resume samples, 06 jun 2023, 50 hobbies & interests in resume for freshers, 08 may 2023, resignation letter format, 02 may 2023, bca interview tips, 15 apr 2023, how to write your best resume in 2023, 26 feb 2023, best bca fresher resume formats, 25 mar 2023, best bba fresher resume formats, hobbies in resume for freshers, 03 apr 2023, how to find internship opportunities for freshers, 02 apr 2023, what hobbies to include in fresher resumes, 26 apr 2023, how to improve your english for jobs, 19 feb 2023, freshers - how to find your first job, interview tips - why should you ask questions, 3 skills to add to your bca resume, 18 feb 2023, technical skills to add to your bca resume, bca fresher resume and interview tips, how to use online resume makes, best books to read to improve your english, how to write a good cv, 15 feb 2023.

How to Create a Brilliant B.Com Fresher Resume in 2024?

Quick Summary

- Emphasize your B.Com degree, relevant coursework, and specialized skills in your B.Com fresher resume.

- Include practical experience like internships, part-time jobs, and volunteer work to enhance your B.Com fresher resume.

- Tailor your resume for each application using action verbs and quantifiable achievements to stand out as a B.Com fresher.

Table of Contents

4.68 million students are pursuing B.com programs in India, according to the All India Survey of Higher Education ( AISHE ) published by the HRD Ministry.